Affordable & Liveable Property Guide 1st Half 2020 - Melbourne

Melbourne Metro median property prices have softened in view of COVID-19, creating an opportune time for first home buyers wanting to capitalise on a more affordable market.

Overview

Melbourne Metro median property prices have softened in view of COVID-19, creating an opportune time for first home buyers wanting to capitalise on a more affordable market.

From 2018 to 2019/20(1) the number of houses sold in Melbourne Metro increased by 19.1%. However, during this time frame median house prices declined by -11.1% to $1,091,000. Unit sales increased by 12.9%, with the median unit price slightly softening by -1.8% to $600,000.

There is still a healthy demand for properties in Melbourne Metro, however affordability has also increased. This puts Melbourne Metro in a unique position, as first home buyers can benefit from lower prices, while sellers can be confident of market demand. Melbourne Metro is conducive for investment as vacancy rates were recorded at a healthy 2.8% in April 2020, indicative of rental properties being occupied relatively quickly.

A key finding in the Affordable and Liveable Melbourne Property Guide 1st Half 2020 report is that most of the affordable and liveable suburbs identified continue to be spread out overall, with some concentration to the north of the Melbourne CBD. These suburbs have ticked the right boxes regarding the best possible affordability while also satisfying other criteria such as: low vacancy rates, high yields, large infrastructure spending, low crime and proximity to amenities.

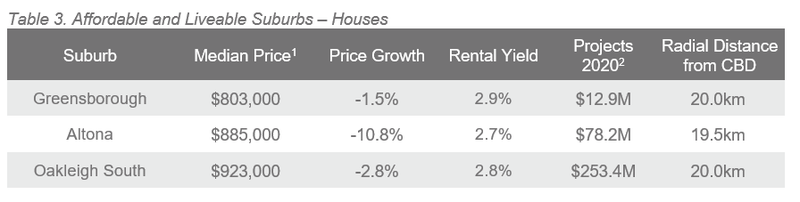

Table 1 highlights top suburbs in Melbourne Metro based on price growth and total estimated value of projects commencing in the 1st half of 2020(2).

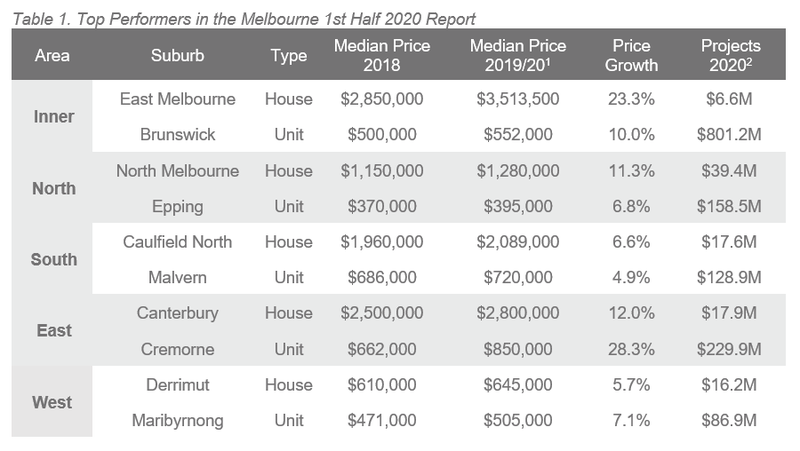

Access to Market

In the 1st half of 2020, the Melbourne Metro property market continues to be a prime market for buyers with a $500,000-$800,000 budget, with 41.4% of suburbs within this price range. This is quite a significant increase over the past 18 months increasing from 21.7% in the 2nd Half 2018(¥) report. During this period first home buyer activity has increased in Melbourne Metro, as the price bracket of less than $500,000 grew from 1.4% of suburbs to 4.9%.

Table 2 provides the percentage of suburbs in Melbourne Metro that are available for house buyers.

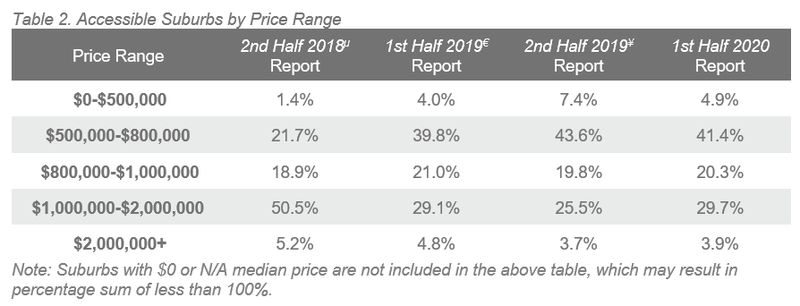

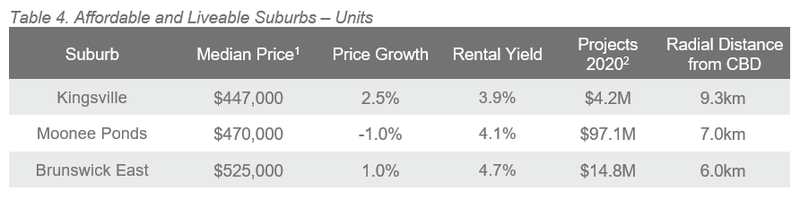

Affordable & Liveable Suburbs

To identify affordable and liveable suburbs, the percentage premium needed to be added to the VIC average home loan in the 1st half of 2020 is 79%, lower than the 90% added in the 2nd Half 2019(µ) report. Further, it is lower than the 111% premium that is needed to reach the Melbourne Metro median house price. A similar pattern can be seen in the unit market, which suggests that the cost of liveability has improved in Melbourne Metro.

Considering all methodology criteria (property trends, investment, affordability, development, and liveability), Tables 3 and 4 identify key suburbs that property watchers should be on the lookout for.

Over Q1 2020, the Melbourne Metro rental market recorded

a median rental price of $410 per week for houses and $460 per week for units,

representing quarterly median price growth of 2.5% for houses and 4.5% for

units. Melbourne Metro’s vacancy rate of 2.8% (as of April 2020), sits below

the Real Estate Institute of Australia’s healthy benchmark of 3.0%. During this

time, Melbourne Metro’s rental yields were recorded at 2.7% (houses) and 3.9%

(units), sitting above Sydney Metro (houses 2.5%; units 3.5%). With a lower

entry price, Melbourne Metro presents itself as a more affordable attractive

investment alternative.

Over Q1 2020, the Melbourne Metro rental market recorded

a median rental price of $410 per week for houses and $460 per week for units,

representing quarterly median price growth of 2.5% for houses and 4.5% for

units. Melbourne Metro’s vacancy rate of 2.8% (as of April 2020), sits below

the Real Estate Institute of Australia’s healthy benchmark of 3.0%. During this

time, Melbourne Metro’s rental yields were recorded at 2.7% (houses) and 3.9%

(units), sitting above Sydney Metro (houses 2.5%; units 3.5%). With a lower

entry price, Melbourne Metro presents itself as a more affordable attractive

investment alternative.

A total of approximately $17.7B(3) of new infrastructure spending will be invested in Greater Melbourne throughout the 1st half of 2020. A key mixed-use project is the Fisherman's Bend Urban Renewal Project ($1.0B). This project will construct residential, commercial and retail precincts. The area is to be transformed into a total of 4 new CBD style mini-suburbs and an employment precinct, accommodating up to 80,000 people. A key commercial project is the University of Melbourne Student Precinct ($229.0M), and a key infrastructure project is Sunbury to Cranbourne Pakenham Corridor Rail Project ($571.5M).

Methodology

This affordable and liveable property guide for Melbourne analyses all suburbs in the Greater Melbourne area, within a 20km radius of the Melbourne CBD. The following criteria were considered:

Property trends criteria – all suburbs have a minimum of 20 sales transactions for statistical reliability purposes. Based on market conditions suburbs have either positive, or as close as possible to neutral price growth from 2018 to 2019/20(1).

Investment criteria – as of April 2020, all suburbs considered will have an on-par or higher rental yield than Melbourne Metro, and an on-par or lower vacancy rate.

Affordability criteria – identified suburbs have a median price below a set threshold. This was determined by adding percentage premiums to the Victoria (VIC) average home loan, which was $515,741(3) as of Q1 2020. Premiums of 79% for houses and 2% for units were added, which were below those required to reach Melbourne Metro’s median prices (111% for houses and 16% for units). This places the suburbs below Melbourne Metro’s median prices, meaning that the suburbs identified within this report are more affordable for buyers.

Development criteria –suburbs identified within this report have a high total estimated value of future project development for the 1st half of 2020, as well as a higher proportion of commercial and infrastructure projects. This ensures the suburbs show signs of sustainable economic growth, in turn having a positive effect on the property market.

Liveability criteria – this included ensuring all suburbs assessed have low crime rates, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres and health care facilities), and an unemployment rate on-par or lower in comparison to the state average (as determined by the Department of Jobs and Small Business, December Quarter 2019 release).

Affordable and Liveable Property Guide 1st Half 2020 - Melbourne