National Affordable & Liveable Property Guide 1st Half 2020

The PRD Affordable and Liveable Property Guides 1st Half 2020 are available for Brisbane, Sydney, Melbourne and Hobart. These guides provide valuable insights and highlights of the market and report on many key indicators to create a holistic picture of property conditions in each capital city.

Overview

The PRD Affordable and Liveable Property Guides 1st Half 2020 are available for Brisbane, Sydney, Melbourne and Hobart. These guides provide valuable insights and highlights of the market and report on many key indicators to create a holistic picture of property conditions in each capital city.

There were several key findings in the 1st Half 2020 report:

- 1. Brisbane reveals dominance to the north (as per the 2nd Half 2019(µ) report), while in Sydney this appears in the south-west (as per the 2nd Half 2019(µ) report). Identified affordable and liveable suburbs in Hobart and Melbourne were more widely spread geographically with some clustering in Melbourne’s north and Hobart’s east evident, thus residents of Brisbane and Sydney are more restricted in their choice of affordable and liveable suburbs.

- 2. Some capital cities experienced market cooling from 2018 to 2019/20(1), which meant many suburbs recorded negative growth. This resulted in a slight adaptation of the methodology set, whereby suburbs with median price growth as close as possible to neutral (i.e. zero) were considered in choosing affordable and liveable suburbs.

- 3. COVID-19 has made its mark in the 1st half of 2020, with many rental markets changing due to loss of employment and new Federal Government regulations. This has impacted the investment landscape, and thus the methodology set. Rental yields were permitted to be similar, rather than above, the capital city benchmarks. Vacancy rates were permitted to be similar, rather than below, the capital city benchmarks.

- 4. None of the affordable house suburbs in Hobart were able to satisfy either the liveability and/or investment criteria. To ensure liveability and/or investment aspects were met, the premium percentage added to the respective Tasmania (TAS) average home loan(3) had to be higher than the premium percentage added to reach the respective Hobart Metro median price. This suggests that residents of Hobart need to sacrifice affordability to ensure liveability and/or investment potential.

- 5. Despite a market cooling in some capital cities, there is a reduced percentage of houses available in the lowest price range bracket (below $500,000 for all capital cities except for Hobart, which was $350,000) in Melbourne, Sydney and Hobart. However, this was not the case for Brisbane.

Cost of Liveability

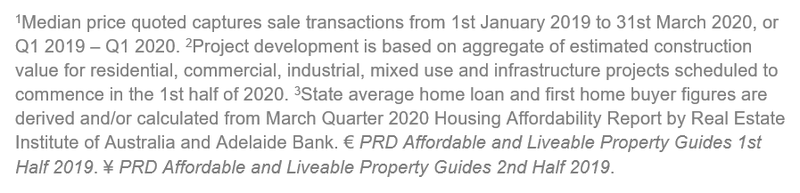

Table 1 illustrates the difference between the required premium percentage (added to the state average home loan(3) for each capital city) to reach the respective capital city metro median price, and the premium percentage required to identify affordable and liveable suburbs which met all methodology criteria (liveability, investment, and project development).

It is important to note that these premium percentages are affected by two key variables:

- median price movements in the market, and

- the ability of a suburb to meet the liveable criteria.

The cost of liveability is the highest in Hobart, as it is the only capital city that recorded a positive premium difference (of 5% for houses). Hobart buyers need to be willing to pay more in exchange for better liveability. Note however that it was not significantly higher than the required premium percentage to reach Hobart Metro’s median price, suggesting liveability and affordability is improving.

Sydney has the most affordable liveability, closely followed by Melbourne. These two capital cities have recorded the largest negative premium difference for both houses and units, which is good news for residents. Median price movements have had the largest impact in Sydney and Melbourne, with both recording negative median price growth from 2018 to 2019/20(1).

From the perspective of the house premium percentage added to find affordable and liveable suburbs, Brisbane is the least expensive (51%), while Sydney is the most expensive (95%).

Access to Market

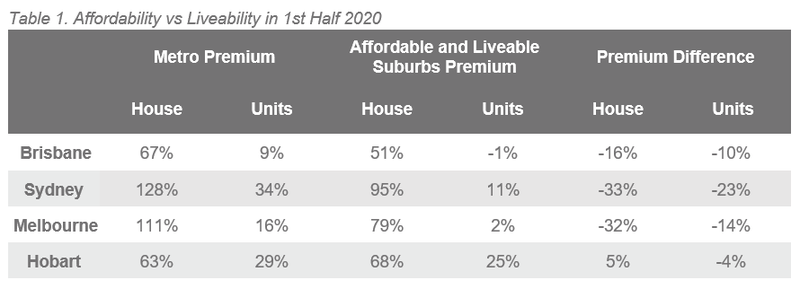

First home buyer activity continues to be a focal point in the 2020 property market. Table 2 suggests there is increasing hope for first home buyers, particularly in Brisbane, where the lowest price range (of less than $500,000) remains truly open for first home buyers. Now is an ideal time for first home buyers to enter the market.

Affordable & Liveable Suburbs - National

Considering all methodology criteria (property trends, investment potential, affordability, project development, and liveability factors), Table 3 identifies key affordable and liveable suburbs which property watchers should look out for in 2020.

It is evident that in general, Sydney and Melbourne have the highest entry prices, yet the lowest rental yields. This is a similar pattern to the 2nd Half 2019(µ) report, despite a market cooling. Hobart median prices are now on-par with Brisbane, which suggests affordability has declined in Hobart. Based on this, the most affordable capital city is now arguably Brisbane, giving home buyers and investors most “bang for buck”. This is particularly true in the unit market, due to having the lowest median prices and highest rental yields.

Methodology

Each report focuses on suburbs within a 20km radius of the CBD (or 10km for Hobart), taking into consideration the following criteria:

Property trends criteria – all suburbs have a minimum of 20 transactions (or 10 transactions for Hobart) for statistical reliability purposes. Based on market conditions, suburbs have either positive, or as close as possible to neutral price growth from 2018 to 2019/20(1).

Investment criteria – as of April 2020, all suburbs considered will have a similar or higher rental yield than the relevant Capital City Metro area, and a similar or lower vacancy rate.

Affordability criteria – identified suburbs have a median price below a set threshold. This threshold was set by adding a percentage premium to the respective state’s average home loan(3). This percentage premium must result in a price threshold below the capital city’s median price in order to ensure affordability.

Development criteria – all suburbs reviewed have a high total estimated value of project development for the 1st half of 2020, as well as a higher proportion of commercial and infrastructure projects. This ensures sustainable economic growth, which in turn has a positive effect on the property market.

Liveability criteria – all suburbs assessed must have a low crime rate, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres, and health care facilities), and an unemployment rate on-par or lower in comparison to the state average (as determined by the Department of Jobs and Small Business, December Quarter 2019 release).