Q1 2018 Key Market Indicators

The PRD Q1 2018 Key Market Indicators provide a quick snapshot of the current state of affairs from an economic and property market perspective. The Key Market Indicators cover both national and state level data.

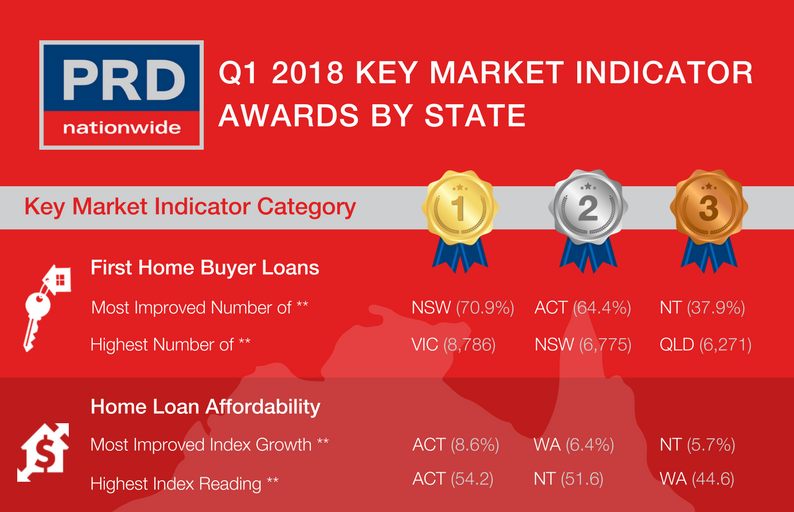

And the most improved number of first home buyer loans gold award goes to…..New South Wales!

The PRD Q1 2018 Key Market Indicators provide a quick snapshot of the current state of affairs from an economic and property market perspective. The Key Market Indicators cover both national and state level data, comprising of:

- Number of first home buyer loans

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

First home buyers has been the topic of many debates over the past couple of years, particularly their ability to crack into the property market. Unexpectedly, New South Wales can now claim the most improved number of first home buyer loans gold award, with the number of first home buyer loans increasing by 70.9% between September quarter 2016 (3,965 loans) to September Quarter 2017 (6,775 loans). The most improved number of first home buyer loans silver award goes to the Australian Capital Territory (64.4%) and the bronze award goes to the Northern Territory (37.9%).

Those looking for more affordable options should consider buying a property in the Australian Capital Territory, as their home loan affordability index reading has grown the most at 8.6% over the past 12 months to September quarter 2017. They also have the highest home loan affordability index at 54.2 points in September 2017, well above the Australian average of 33 index points. This is followed by Western Australia (6.4%) and the Northern Territory (5.7%). Interestingly, New South Wales and Queensland home loan affordability index grew at almost an on par level, at 3.0% and 3.6% respectively. Overall, Australia’s home loan affordability index grew by 1.9% and with all states reporting positive growth there is a positive outlook for affordability.

Australia’s unemployment rate is promising, as it decreased by 3.5% to 5.5 points in January 2018, suggesting that more people are earning disposable income. The Northern Territory leads the way in employment growth, with unemployment rate decreasing by 18.8%. This is followed by Western Australia (-10.9%) and Tasmania (-9.0%).

Based on the three key indicators above (number of first home buyer loans, home loan affordability index, and median family income) it is not surprising that consumer sentiment has increased over the past 12 months, by 3.1% to 102.7 points. This puts us in the positive sentiment category, meaning consumers have a positive outlook towards the national economy and will be more willing to spend, triggering a positive multiplier effect across all industries.

For more information on the PRD Key Market Indicators please contact Dr Diaswati Mardiasmo, National Research Manager.

See the reports for all states