Q1 2019 Key Market Indicators

The Royal Commission investigation into banking practices, along with changes in political leadership and uncertainties regarding negative gearing, have impacted the Australian Consumer Sentiment index reading to fall just below the positive line at 99.6 points in January 2019. This is a -5.2% decline compared to January 2018, and with 2019 being a state and federal election year, it will be interesting to see how the release of the Federal Budget 2019 and monthly cash rate decisions by the Reserve Bank of Australia (RBA) will impact consumer sentiment throughout the year. The Australian Consumer Price Index sat at a 1.8% change in December 2018, declining from a 1.9% change in September 2019, and still outside the RBA’s target band of 2.0-3.0%. This indicates that the economy is still not performing to its full capacity.

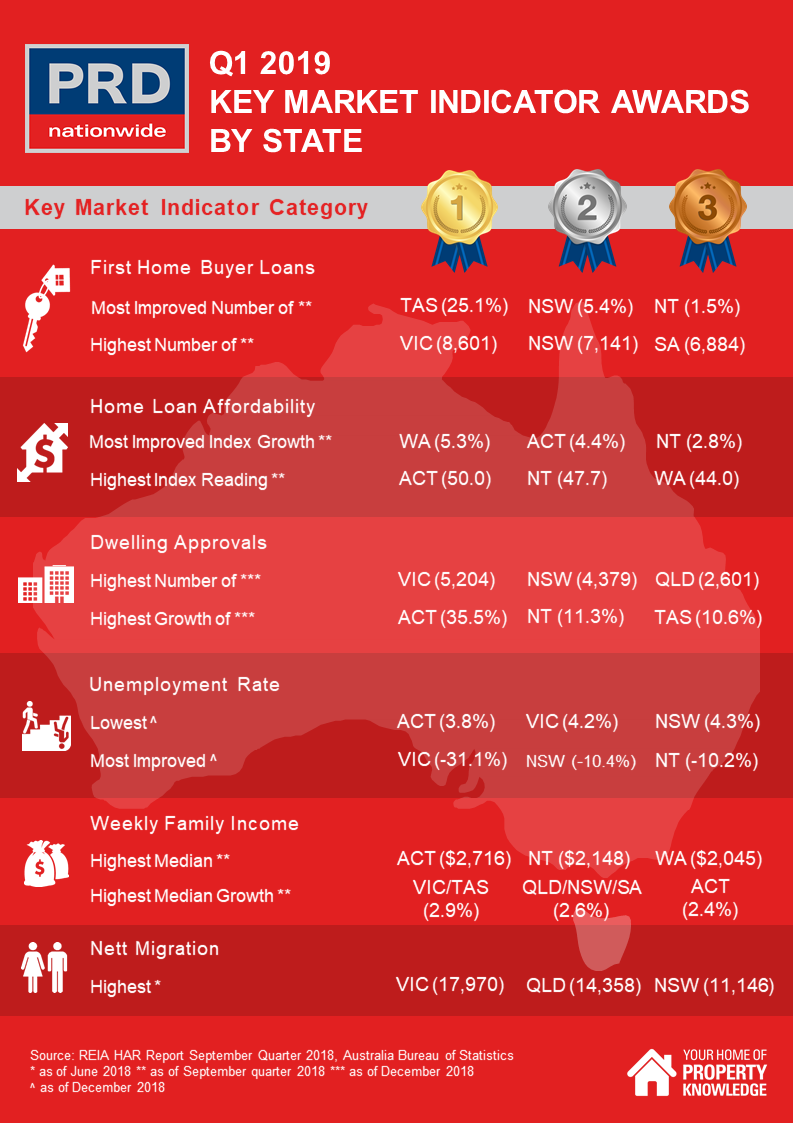

Victoria leads, and Tasmania back on track!

2019 has opened with promise, particularly in regard to home affordability. The home affordability index has grown by 2.6% over the past 12 months (to the end of the September quarter of 2018), at a reading of 31.9 index points.

The Royal Commission investigation into banking practices, along with changes in political leadership and uncertainties regarding negative gearing, have impacted the Australian Consumer Sentiment index reading to fall just below the positive line at 99.6 points in January 2019. This is a -5.2% decline compared to January 2018, and with 2019 being a state and federal election year, it will be interesting to see how the release of the Federal Budget 2019 and monthly cash rate decisions by the Reserve Bank of Australia (RBA) will impact consumer sentiment throughout the year. The Australian Consumer Price Index sat at a 1.8% change in December 2018, declining from a 1.9% change in September 2019, and still outside the RBA’s target band of 2.0-3.0%. This indicates that the economy is still not performing to its full capacity.

The number of first home buyer loans in Australia declined by -3.7% over the past 12 months (to the September quarter of 2018), which may seem like a disappointing result considering the RBA has held the cash rate at a historical low over the past 28 months. This is reflective of tighter lending criteria enforced by banks, political instability, and a downturn in some capital markets. First home buyers are waiting for the optimal time to enter the market and are watching property trends closely. It would not come as a surprise if there was a spike in first home buyer activity towards the end of 2019.

The PRD Q1 2019 Key Market Indicators provide a quick snapshot of the current state of the market in Australia, from both an economic and property perspective. The Indicators cover both national and state level data, comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

In the PRD Q1 key market indicators Victoria leads the nation, taking out 5 gold awards nationally for: highest number of first home buyer loans, highest number of dwelling approvals, most improved unemployment rate, highest growth in median weekly family income, and highest nett migration. The Australian Capital Territory took out 4 gold awards nationally for: highest home loan affordability index reading, lowest unemployment rate, highest growth in number of dwelling approvals, and highest median weekly family income.

First home buyer growth was a concern in Tasmania in mid-late 2018, with the number of first home buyers declining at a rapid rate. The September quarter of 2018 saw the number of first home buyers in TAS increase by 25.1% (over the past 12 months), earning the state a gold award nationally. This brings TAS “back on track” as a haven for first home buyers.

View the State and Territory Q4 2018 Key Market Indicators:

- Q1 2019 Key Market Indicators – Western Australia

- Q1 2019 Key Market Indicators – Northern Territory

- Q1 2019 Key Market Indicators – Queensland

- Q1 2019 Key Market Indicators – South Australia

- Q1 2019 Key Market Indicators – New South Wales

- Q1 2019 Key Market Indicators – Australian Capital Territory

- Q1 2019 Key Market Indicators – Victoria

- Q1 2019 Key Market Indicators – Tasmania