Q2 2018 Key Market Indicators

The PRD Q2 2018 Key Market Indicators provide a quick snapshot of the current state of affairs in Australia from both an economic and property perspective.

The PRD Q2 2018 Key Market Indicators provide a quick snapshot of the current state of affairs in Australia from both an economic and property perspective. The Indicators cover both national and state level data, comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

PRD’s research currently shows the Australian Consumer Sentiment is above the positive line (100 index points), sitting at 102.4 index points as of April. This is a 3.4% increase over the past 12 months and showcases a stable pattern of a positive consumer index, when compared to the previous Q1 key market indicators (102.7 index points).

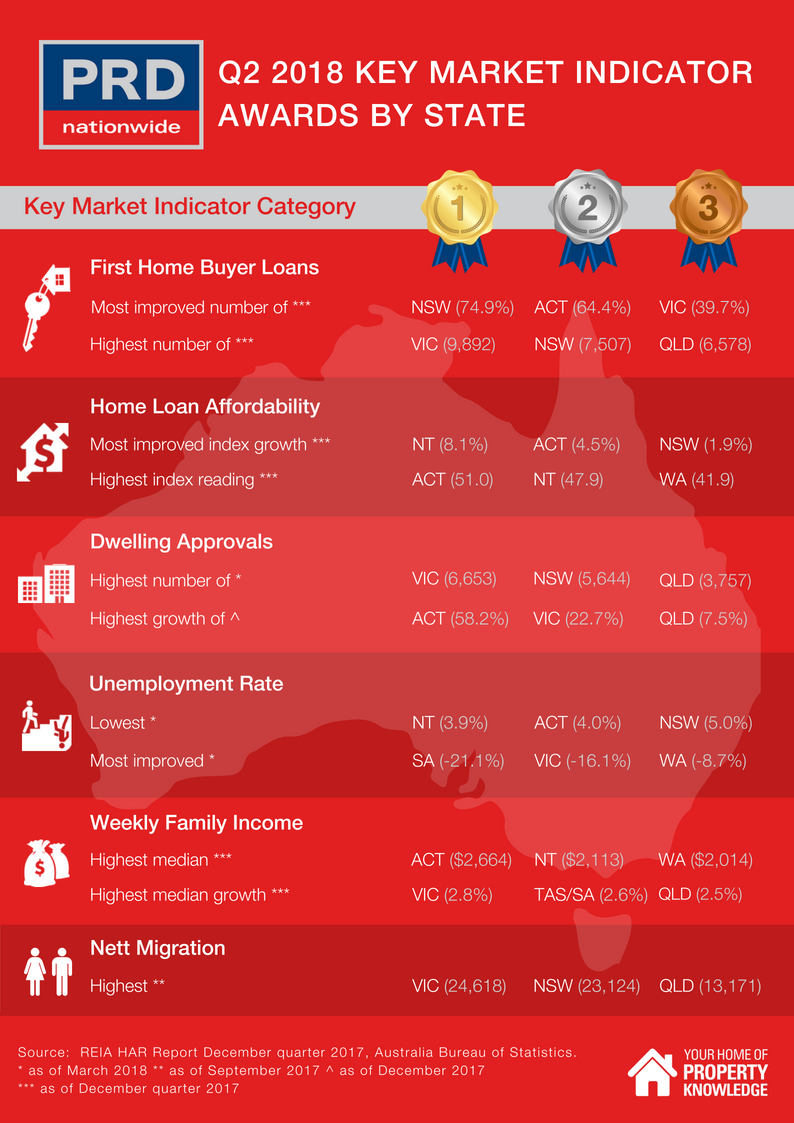

Nationally, Victoria has come out as a clear winner in the Q2 2018 Key Market Indicator Awards, taking out 7 awards nationally (4 golds, 2 silvers and 1 bronze). Victoria has also edged out South Australia to take the lead for highest median weekly family income growth (2.8%), with South Australia claiming a silver award nationally (2.6%) equal to Tasmania. The Australian Capital Territory continues to stand out in the highest median weekly family income category at $2,664.

Victoria has maintained its gold award status quarter on quarter in the highest number of first home buyer loans category, recording 9,892 loans in the December quarter of 2017. The state with the most improved number of first home buyer loans goes to New South Wales who have kept their gold award status in Q2, increasing by 74.9% compared to 70.9%. This is seen as a result of Sydney’s cooling property prices and increasing number of stock being supplied in the outer ring and regional New South Wales. Tasmania had a disappointing run this quarter, previously known as the more affordable option in comparison to New South Wales, it recorded the lowest growth in the number of first home buyer loans at 4.0%.

In

terms of home loan affordability, the Australian Capital Territory once again

takes the gold award nationally for

highest home loan affordability index reading in Q2 at 51.0 index points,

which is well above the Australian average of 31.6 index points. Overall,

Australian home loan affordability increased by a mere 0.3% over the past 12

months. The Australian Capital Territory has lost its leadership position to

Northern Territory for most improved home

affordability loan index growth whose affordability loan index grew by a

positive 8.1% over the past 12 months.

View the State and Territory Q2 2018 Key Market Indicators:

- Northern Territory

- Queensland

- Western Australia

- South Australia

- New South Wales

- Australian Capital Territory

- Victoria

- Tasmania