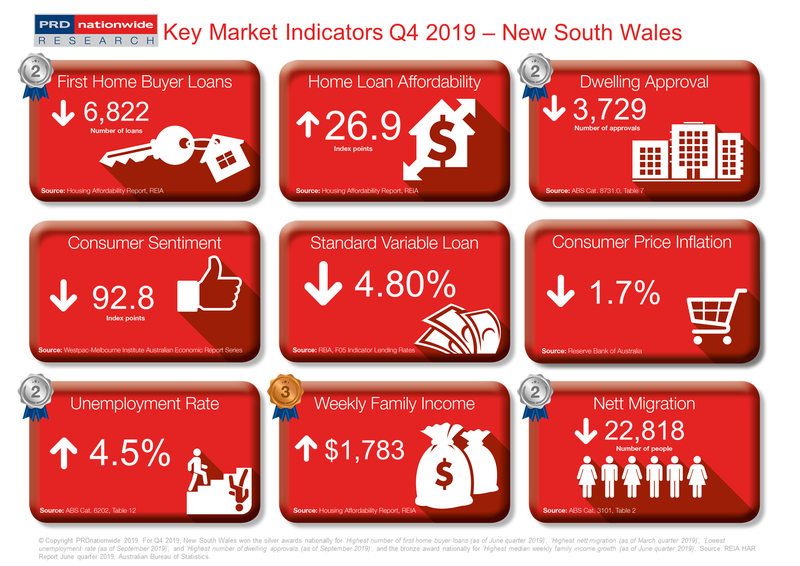

Q4 2019 Key Market Indicators – New South Wales

New South Wales (NSW) recorded a home loan affordability index reading of 26.9 points, which represents a 2.3% improvement in the 12 months to the June quarter of 2019. Although this is below the Australian average growth of 3.5% during the same period, it is above traditionally affordable states such as Queensland (QLD), South Australia, and Tasmania (TAS)

Confidence returns in New South Wales

New South Wales (NSW) recorded a home loan affordability index reading of 26.9 points, which represents a 2.3% improvement in the 12 months to the June quarter of 2019. Although this is below the Australian average growth of 3.5% during the same period, it is above traditionally affordable states such as Queensland (QLD), South Australia, and Tasmania (TAS); all of which experienced a decline in the home loan affordability index.

NSW recorded

6,822 new first home buyer loans in the June quarter of 2019, earning it a

silver award nationally in the Highest

Number of First Home Buyer Loans category

of the PRD Q4 2019 Key Market Indicator Awards.

Although this represents a -5.9% decline in the past 12 months, this is a lower

decline compared to the 12 months to the March quarter of 2019 (-11.0%). It is

also a lower decline than traditionally affordable states such as QLD (-17.8%)

and TAS (-6.1%). First home buyer confidence has returned in NSW, albeit not to

the full extent.

Strong economic fundamentals exist in NSW, with its unemployment rate of 4.5% in September 2019 earning it a silver award nationally in the Lowest Unemployment Rate category. Although this represents an increase of 2.3% in the past 12 months, this is a lower increase compared to the Australian average of 4.0%. Furthermore, the NSW unemployment rate sits lower than the Australian unemployment rate of 5.2%. The median weekly family income increased by 2.7% in the 12 months to the June quarter of 2019, thus those employed now have higher disposable income. This will have a positive impact not only on the real estate market but also the economy.

NSW earned a silver award nationally in the Highest Nett Migration category, with 22,818 new residents. This may result in higher property demand, and as dwelling approvals declined by -26.3% in the 12 months to the June quarter of 2019, it will allow for current stock to be absorbed.

The PRD Q4 2019 Key Market Indicators report provides a quick

snapshot of the current state of the market in Australia from both an economic

and property perspective. The Indicators cover both national and state-level

data, comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

View all Q4 2019 Key Market Indicators.