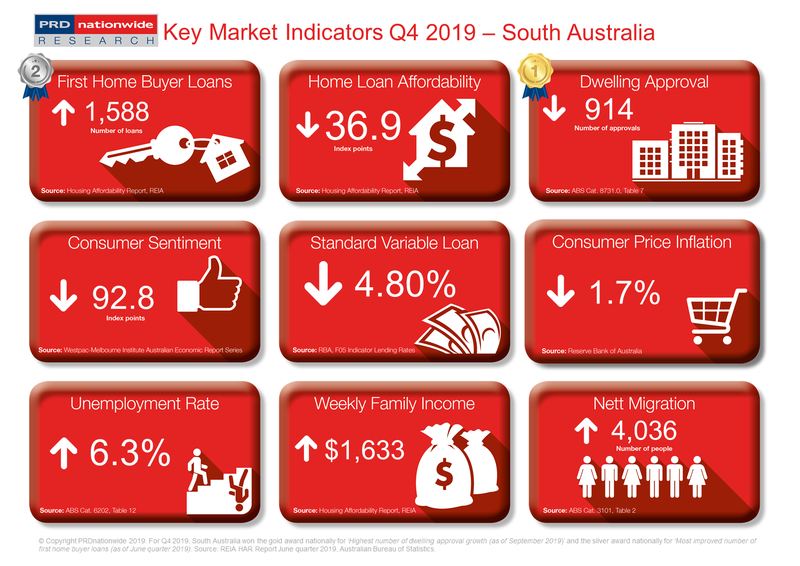

Q4 2019 Key Market Indicators – South Australia

South Australia (SA) recorded 1,588 first home buyer loans in the June quarter of 2019, which was a 10.2% increase in the past 12 months. Not only does this earn the state a silver award nationally in the Most Improved Number of First Home Buyer Loans category (in the PRD Q4 2019 Key Market Indicator Awards), but it is also in contrast to the -7.6% declining pattern nationwide.

First home buyers thrive in South Australia

South Australia (SA) recorded 1,588 first home buyer

loans in the June quarter of 2019, which was a 10.2% increase in the past 12

months. Not only does this earn the state a silver award nationally in the Most Improved Number of First Home Buyer Loans

category (in the PRD Q4 2019 Key Market Indicator Awards), but it is also in contrast to the

-7.6% declining pattern nationwide. Other than the Northern Territory, SA is

the only state recording positive growth. This is a step up compared with the March

quarter of 2019, where SA recorded a 5.6% annual increase in first home buyer

loans. Thus, first home buyer’s confidence is high in SA in contrast with the

rest of the country.

In the March quarter of 2019, SA recorded an extra 4,036

people through nett migration, which equates to a 15.0% increase in the past 12

months. This is a much higher growth in nett migration than NSW (-6.3%), VIC

(0.9%), and QLD (-1.6%), thus there is a higher chance of increasing property

demand in SA, and presents an opportunity for developers. Furthermore, SA’s

median weekly family income increased by 2.6% in the 12 months to the June

quarter of 2019, which shows those working have a higher disposable income.

This will have a positive impact not only on the real estate market but also

the economy.

The PRD Q4 2019 Key Market Indicators report provides a quick snapshot of the current state of the market in Australia from both an economic and property perspective. The Indicators cover both national and state-level data, comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

View all Q4 2019 Key Market Indicators