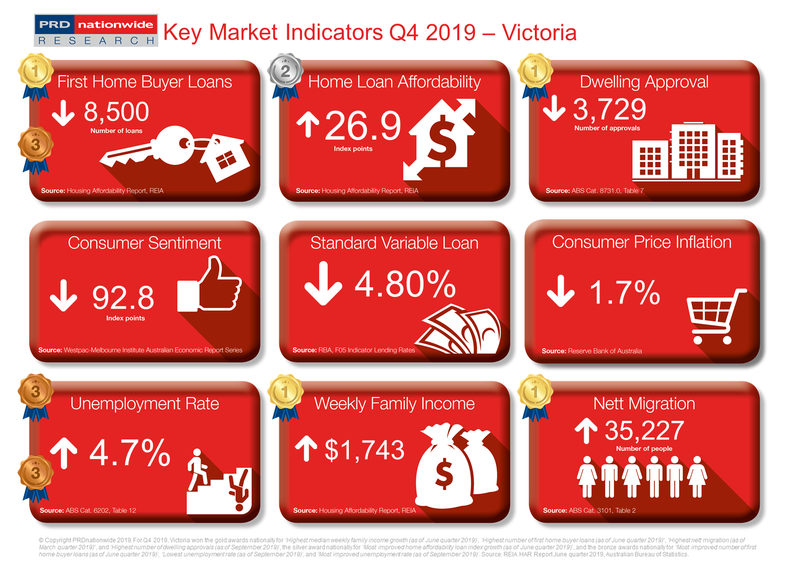

Q4 2019 Key Market Indicators – Victoria

ictoria (VIC) has earned a gold award nationally in the Highest Nett Migration category in PRD’s Q4 2019 Key Market Indicator Awards, recording an additional 35,227 people in the March quarter of 2019. This represents a 0.9% growth in the past 12 months.

Victoria leads in future housing demand

Victoria (VIC) has earned a gold award nationally in the Highest Nett Migration category in PRD’s Q4 2019 Key Market Indicator Awards, recording an additional 35,227 people in the March quarter of 2019. This represents a 0.9% growth in the past 12 months, which contrasts with the -6.3% and -1.6% declining pattern of New South Wales (NSW) and Queensland (QLD). An increase in population suggests a potential increase in housing demand. With dwelling approvals declining by -20.0% in the 12 months to September 2019, this indicates a unique opportunity for property developers.

The VIC home loan affordability index was 30.7 points in the June quarter of 2019, which represents a 5.1% increase in the past 12 months. This is above the Australian average home loan affordability index growth of 3.5% during the same period, which earned VIC a silver award nationally in the Most Improved Home Loan Affordability Index Growth category. First home buyers are gaining confidence in VIC, with 8,500 first home buyer loans recorded in the June quarter of 2019. This earned VIC a gold award nationally for the Highest Number of First Home Buyer Loans category. Although this represents a -5.7% decline in the past 12 months, it is a more moderate decline compared with NSW (-5.9%) and QLD (-17.8%).

Strong economic fundamentals remain in VIC, despite a 2.2% increase in its unemployment rate in the 12 months to September 2019. This brings the VIC unemployment rate to 4.7%, which is still lower than the Australian average of 5.2%. Furthermore, VIC’s unemployment rate increase was half of the Australian average increase (4.0%). VIC achieved a gold award nationally for the Highest Median Weekly Family Income Growth category, which was 3.0% in the 12 months (to the June quarter of 2019). This means that those employed now have higher spending and saving capacity. This will have a positive impact not only on the real estate market but also the economy.

The PRD Q4 2019 Key Market Indicators report provides a quick snapshot of the current state of the market in Australia from both an economic and property perspective. The Indicators cover both national and state-level data, comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

View all Q4 2019 Key Market Indicators