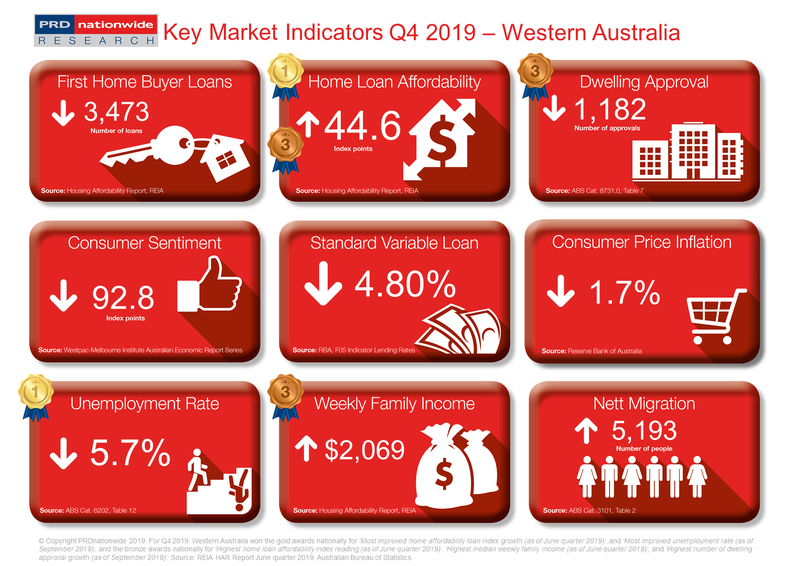

Q4 2019 Key Market Indicators – Western Australia

Western Australia (WA) recorded a home loan affordability index reading of 44.6 points in the June quarter of 2019, earning the state a bronze award nationally for the Highest Home Loan Affordability Index Reading category. This is much higher than the Australian home loan affordability index reading of 32.2 points, and cements WA as one of the most affordable states in the country.

Affordable housing in Western Australia opens opportunities for first home buyers

Western Australia (WA) recorded a home

loan affordability index reading of 44.6 points in the June quarter of 2019,

earning the state a bronze award nationally for the Highest Home Loan Affordability Index Reading category (in the PRD Q4 2019 Key Market Indicator Awards). This is much higher than the Australian home loan

affordability index reading of 32.2 points, and cements WA as one of the most

affordable states in the country; slightly behind the Northern Territory and

the Australian Capital Territory. Those looking for highly affordable options

should consider WA, particularly as its home loan affordability index improved

by 6.7% in the 12 months to the June quarter of 2019, which was much higher

than the Australian average growth of 3.5%. Due to this, WA earned a gold award

nationally for the Most Improved Home Loan

Affordability Index Growth category.

Interestingly,

despite a more affordable property market, the number of first home buyer loans

approved declined by -7.5% in the 12 months to the June quarter of 2019. That

said, this is on par with the Australian average decline of -7.6% during the

same period, which suggests that there were other factors (other than property

prices) in play, such as tighter lending policies.

The WA unemployment rate was 5.7% in September 2019, representing a -6.6% decline in the past 12 months. This is the largest improvement in the unemployment rate of all states, earning WA a gold award nationally in the Most Improved Unemployment Rate category. Median weekly family income in WA was $2,069 in the June quarter of 2019, representing a 2.0% increase in the past 12 months. This is a lower increase than the Australian average of 2.6%, however, it is counterbalanced with the large increase in the number of people employed.

Nett migration to WA was recorded at 5,193 in the March quarter of 2019, which was a significant increase compared to the 2,466 increase recorded in the March quarter of 2019. This will allow for current stock to be absorbed by the market.

The

PRD Q4 2019 Key Market Indicators report provides a quick snapshot of the

current state of the market in Australia from both an economic and property

perspective. The Indicators cover both national and state-level data,

comprising of:

- Number of loans to first home buyers

- Home loan affordability index

- Number of dwelling approvals

- Consumer sentiment index

- Standard variable loan

- Consumer price inflation index

- Unemployment rate

- Weekly family income

- Nett migration

View all Q4 2019 Key Market Indicators