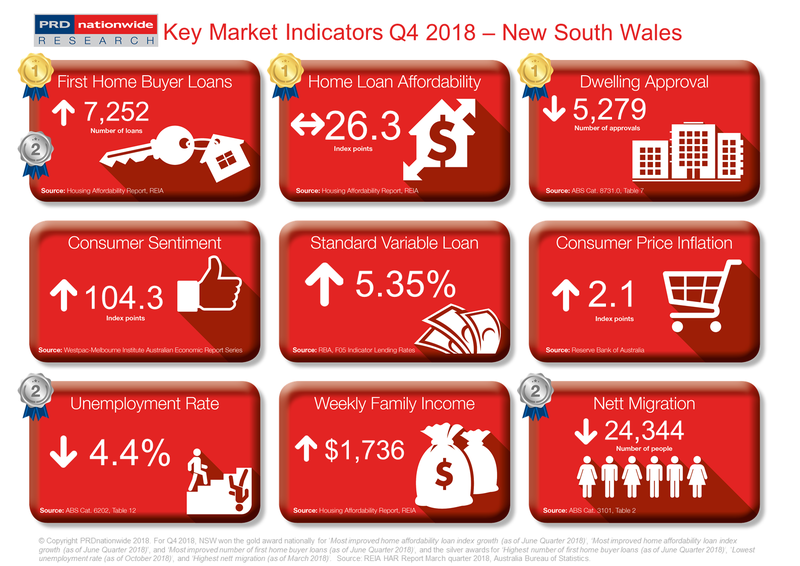

Q4 2018 Key Market Indicators – New South Wales

New South Wales (NSW) has recently become much more welcoming for first home buyers. In the June quarter 2018, the state achieved the gold award nationally for the most improved number of first home buyer loans with a 68.8% increase over the past 12 months. It also achieved the silver award nationally for the highest number of first home buyer loans (as of June quarter 2018) with 7,252 such loans issued. This has been driven in part by being the only state to not decline in affordability over this period, helping it achieve the gold award nationally for the most improved home affordability loan index growth (as of June quarter 2018).

Solid economics sustain New South Wales

New South Wales (NSW) has recently become much more welcoming for first

home buyers. In the June quarter 2018, the state achieved the gold award

nationally for the most improved number of first home buyer loans with a 68.8% increase over the past 12

months. It also achieved the silver award nationally for the highest number

of first home buyer loans (as of June quarter 2018) with 7,252 such

loans issued. This has been driven in part by being the only state to not

decline in affordability over this period, helping it achieve the gold award

nationally for the most improved

home affordability loan index growth (as of June quarter 2018). Another notable achievement for NSW was winning the

gold award nationally for the highest

number of dwelling approvals (as of September 2018), making it a top

performer with 5,279 approvals. This rate was -16.7% softer than the period 12

months prior (September 2017), which is indicative of the cooling being

experienced within the wider property market, largely lead by Sydney. That said,

nett migration operated at a similar softer rate of -15.1% across the 12 months

prior to March 2018, which will lead to a balance in supply and demand. This

will achieve a more sustainable rate of property price growth in the long run.

Another notable achievement for NSW was winning the

gold award nationally for the highest

number of dwelling approvals (as of September 2018), making it a top

performer with 5,279 approvals. This rate was -16.7% softer than the period 12

months prior (September 2017), which is indicative of the cooling being

experienced within the wider property market, largely lead by Sydney. That said,

nett migration operated at a similar softer rate of -15.1% across the 12 months

prior to March 2018, which will lead to a balance in supply and demand. This

will achieve a more sustainable rate of property price growth in the long run.

NSW had a low unemployment rate of just 4.4% this quarter, awarding it the silver award nationally for lowest unemployment rate (as of October 2018). This was an improvement on the rate achieved 12 months prior, suggesting that employment conditions remain strong. Further, the state won the bronze award nationally for the highest median weekly family income growth (as of June quarter 2018), at 2.4%. Combined with a low unemployment rate, this places NSW as a leader in the market, with strong underlying economic fundamentals.

The PRD Q4 2018 Key Market Indicators provide a quick snapshot of the current state of the market in Australia from both an economic and property perspective. The Indicators cover both national and state level data, comprising of:

- Number

of loans to first home buyers

- Home

loan affordability index

- Number

of dwelling approvals

- Consumer

sentiment index

- Standard

variable loan

- Consumer

price inflation index

- Unemployment

rate

- Weekly

family income

- Nett

migration

View the Q4 2018 Key Market Indicators