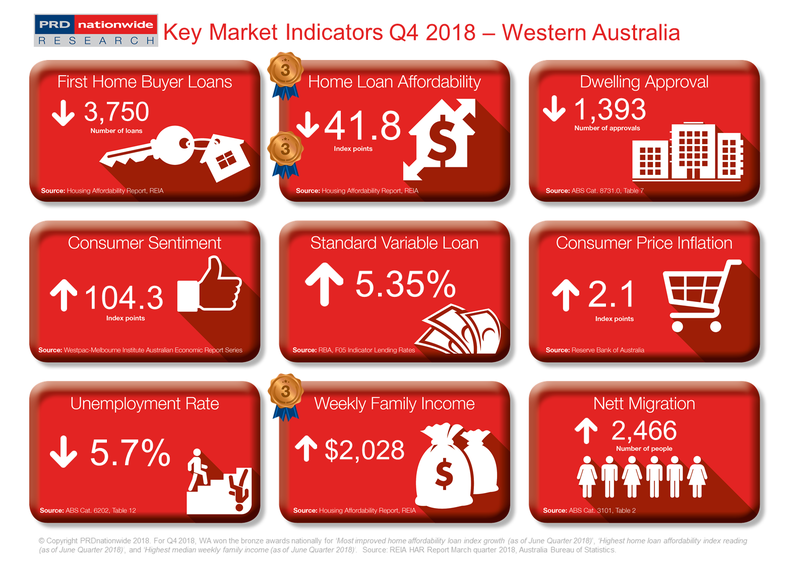

Q4 2018 Key Market Indicators – Western Australia

As of June 2018, WA’s home loan affordability index reading was 41.8 index points, well above the Australian average of 31.1 index points. That said, this is a slight decline when compared to the March quarter of 2017, where WA recorded a home loan affordability index reading of 42.8 points. This is potentially explained by the mild increase in WA’s property metro prices, due to higher quality stock entering the market over the past 6 months.

Western Australia presents unique affordable options.

Western Australia (WA) has again earned the bronze award nationally

for both highest home loan affordability

index reading and highest median

weekly family income categories in the PRD Q4 2018 Key Market Indicator Awards. WA also won these awards in Q3

2018. As of June 2018, WA’s home

loan affordability index reading was 41.8 index points, well above the

Australian average of 31.1 index points. That said, this is a slight decline

when compared to the March quarter of 2017, where WA recorded a home loan

affordability index reading of 42.8 points. This is potentially explained by

the mild increase in WA’s property metro prices, due to higher quality stock

entering the market over the past 6 months.

As of June 2018, WA’s home

loan affordability index reading was 41.8 index points, well above the

Australian average of 31.1 index points. That said, this is a slight decline

when compared to the March quarter of 2017, where WA recorded a home loan

affordability index reading of 42.8 points. This is potentially explained by

the mild increase in WA’s property metro prices, due to higher quality stock

entering the market over the past 6 months.

Nett migration into WA has increased by a significant 41.5% over the past 12 months to March 2018, which is the second highest growth in nett migration figures across Australia. This is great news for the property market as it will allow for current stock to be absorbed. Furthermore, dwelling approvals have declined by -17.1% over the past 12 months to September 2018, which suggests that there may even be a potential undersupply in the market in the long run.

WA continues to be a top performer for income, earning a bronze award nationally in the highest median weekly family income category, with the median weekly family income increasing from $2,021 in the March quarter of 2018, to $2,028 in the June quarter of 2018. This represents a 1.7% increase, which is a stable increase compared to the December quarter of 2017 to the March quarter of 2018’s growth. Furthermore, unemployment in WA declined by -5.0% over the past 12 months to October 2018, thus there are more people with incomes. Combined, these two factors create solid fundamentals for a resilient economy in 2019.

The

PRD Q4 2018 Key Market Indicators provide a quick snapshot of the

current state of the market in Australia from both an economic and property

perspective. The Indicators cover both national and state level data,

comprising of:

- Number

of loans to first home buyers

- Home

loan affordability index

- Number

of dwelling approvals

- Consumer

sentiment index

- Standard

variable loan

- Consumer

price inflation index

- Unemployment

rate

- Weekly

family income

- Nett

migration

View the Q4 2018 Key Market Indicators