Q2 2018 Key Market Indicators - Queensland

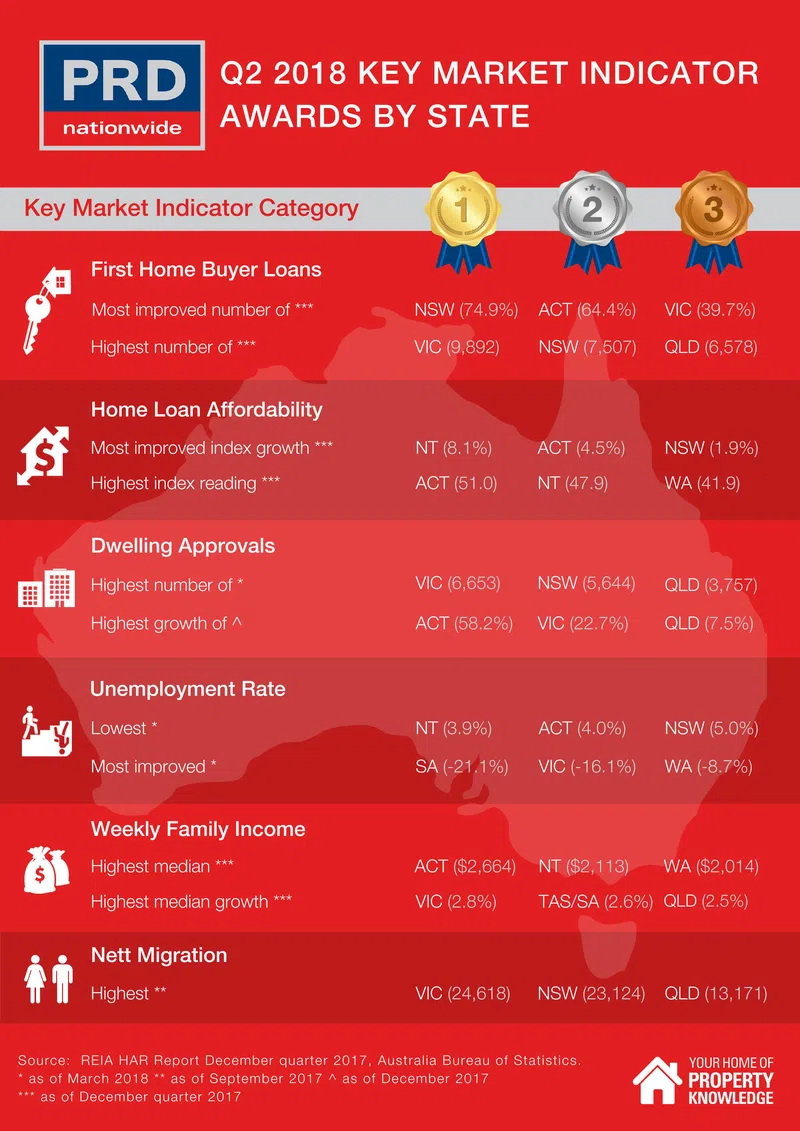

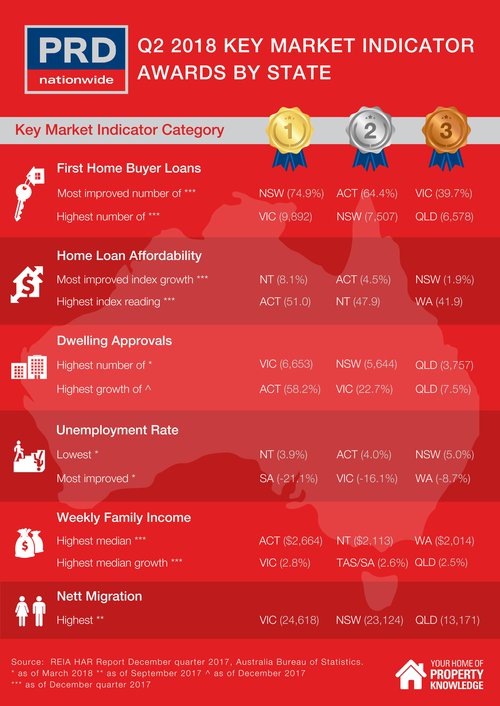

And the bronze for "highest number of first home buyer loans" goes to.... Queensland!

The number of first home buyer loans in Queensland as of December quarter 2017 is 6,578 loans, making it the 3rd highest number of first home buyer loans across the country, after Victoria (9,892 loans) and NSW (7,507 loans). This is an interesting and unexpected result for Queensland, considering that the state has been known for the more affordable property prices in comparison to Victoria and NSW - suggesting that improvements related to first home buyers policies are needed.

That said, there is good news! perhaps more so for non-first home buyers, as Queensland's home affordability loan index increased with a reading of 36.3 index points. This certainly is above NSW and VIC's home affordability loan index (at 26.5 points and 29.9 points respectively) and well above the Australian home loan affordability index (at 33.0 index points). However, it is a pale comparison to the home loan affordability loan index of Western Australia (41.9), Northern Territory (47.9) and ACT (51).

Queensland takes the bronze in the "highest median weekly family income growth" award category, at 2.5%. This is encouraging for Queenslanders, as their median weekly family income climbs up to $1,677 per week - getting closer to the Australian average of $1,711 per week. What's more, the Queensland unemployment rate is 6.3% with a 0.2% improvement from last quarter.

Queensland takes out the bronze for the "highest number of nett migration" reporting 13,171 people, suggesting that the demand for property is about to surge dramatically. Queensland also takes out the bronze for "highest number of dwelling approvals" (as of March 2018) at 3,757 approvals, signifying a 7.5% increase. That said, considering the increase in nett migration, now is the perfect time for developers to make their move.

The PRD Q2 2018 Key Economic Indicators provide consumers with a quick snapshot of the current state of affairs from an economic and property perspective. The PRD Key Economic Indicators cover both National and State level data, comprising of:

a) Number of loans to first home buyers

b) Home loan affordability index

c) Number of dwelling approvals

d) Consumer sentiment index

e) Standard variable loan

f) Consumer price inflation index

g) Unemployment rate

h) Weekly family income

i) Nett migration

For more information on the PRD Q2 2018 Key economic Indicators, please contact Dr. Diaswati Mardiasmo, National Research Manager at astimardiasmo@prd.com.au