The Shape of 2023

The Shape of 2023

(5-Minute Read)

2022 has come and gone, and as we enter 2023, recovery and progress are the focus. The post-pandemic property market and economy have outperformed the pessimistic forecasts thrown around at the start of the year. So, leading into 2023, it's good to review the year that was and prepare for the year to come. It's going to be an excellent year for real estate, entering the market, and property development. PRD Penrith is ready for another terrific year.

A look back at 2022

2022 was a year of expectations. The media, property experts, and economists claimed a catastrophic market crash. Inflation, the pandemic and global crises like the war in Ukraine did not assist the state of Australia's economy, but the grey clouds cleared sooner than most expected.

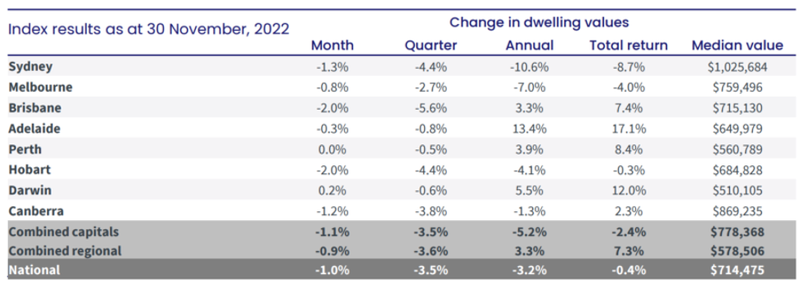

As shown below, the property market undertook a correction. Although the property market is declining, it is still remaining above pre-pandemic highs.

The cash rate was on a steady and somewhat steep incline moving from 0.1% to 3.1%, but with the bank-mandated stress tests and nest eggs gathered during the lockdowns, the RBA deemed that the majority could afford the cash rate hikes. This created a management strategy for the increasing inflation.

According to the ABS, in July of 2022, the unemployment rate hit a 48-year-low dropping to 3.4 per cent. This highlights industries' issues with the provision of competitive wages compared to inflation rates, contributing to the cost of living problems.

The effects of global supply chain disruption and shortage have not been missed in the Australian building industry either. Creating a high demand for building materials and significantly delaying development, these shortages, alongside a need for skilled labour, have exposed flaws in development that are being rapidly remedied.

2022 reassured us that recovering from the pandemic wouldn't be quick, but we've bounced back stronger than expected. The negatives of the year aren't all being carried into 2023; in fact, the trends and forecasts are looking beyond engaging.

2023 - The Forecast

The economy is the hot topic heading into the new year as the public turns their attention to the country's leaders and industry experts to establish an idea of what 2023 holds for the average Australian.

Currently, we are receiving a reprieve from the cash rate hikes as the RBA takes a break over the festive season and will not return to their monthly policy meetings until 2023, meaning any future rate changes won't take effect until March 2023. However, from March, the RBA is predicting further rate increases to reign in the increasing inflation.

The cost of living will remain at a high for the foreseeable future, as the disparity between wage growth and inflation has yet to be managed to the pre-pandemic standards. The ABS released recorded household savings as of December, and the comparison of the 2021 and 2022 September quarters shows the current household savings sit at 6.9%... In 2021 household savings was at 19.8%.

The staggering shift in budgeting throughout the pandemic shows that households are dipping into their savings to manage the current cash rate hikes and cost of living rises. If the RBA predicted further increases, and numerous Australians are 3-6 months away from fixed loans running the course, it seems to be a negative start to the year.

Not quite.

The RBA's November statement regarding policy rate expectations has changed, predicting a higher peak of 4.0% before a gradual stabilisation, returning to a favourable 3.0%. Now, this may seem like a bad thing. But, our economy, like the USA and China, is withstanding the mild recessions and setting into motion a downward pressure on inflation. Recovery is in motion, and 2023-24 are determined to return the economy to its normal state.

The stabilisation of inflation leads to a recovery in aggregate demand, strengthening an already strong business and household balance sheet, in turn creating a multiplier effect on all industries, including the real estate market.

What entering the market in 2023 will look like

The Australian housing market is set for a return to the new status quo. PRD Research Hub shows that the post-pandemic highs are here to stay; the new basis set after the correction is still over 10% higher than the highs of 2020-21.

The forecasts for 2022 prepared for a mass market crash. Instead, the economy recovered faster than economists thought, and we instead got a moderate correction. The changes in price and interest rates have greatly affected consumer confidence going into the following year, but we aren't sure it's quite warranted.

The correction has settled in and is predicted to remain for another 3-6 months before shifting back to a slow price rise. This means that there's still time for those entering the market to remain in the buyer's market. Keep in mind that the festive season and new year slow the market, but as we are seeing this year, sellers are continuing through the holidays due to the looming expiration of fixed rates. This gives buyers additional choices with strengthened bargaining power.

With the RBA's current break in their monthly meetings, the interest rates will remain at a standstill. As the market continues through the holiday period, first-home buyers have the choice, power, and a window of months where their borrowing power is unaffected by shifting cash rates.

Good news is on the horizon for the building industry and property development. Global influences are following recession trends and slowly recovering the industry from the effects of the pandemic and the discourse in Europe. Alongside this, supply chain issues remain but are forecasted to begin resolving issues towards the latter end of 2023. The combination of these factors shows a positive upturn for the property development sectors. The industry is ever-growing, with the demand for housing and infrastructure consistently rising. PRD research states we are up to 24000 dwellings per annum behind where we need to be, and as we head into the new year, the forecasts stipulate that the return of a strong supply chain will further solidify the construction and development industries. This is further great news for our PRD Projects sector and our current projects; East Side Quarter which is wrapping up stage two's build (Aqua) and proceeding with the construction of stage 3 (Eden) in the coming year. Alongside this, Glenmore Village and Solis will continue developing. For further information on PRD's Projects, get in touch with one of our team here at PRD Penrith.

2023 is looking like quite the year. The forecasts spout doom and gloom, but there are positives to take from the year's progression. The property market and economy have, to a degree, recovered. We here at PRD Penrith are looking forward to 2023 and all that it brings. Stay up to date with the latest real estate developments, and get in contact with our team for an obligation-free chat about your property's future. Buy Smarter with PRD Penrith.

Despite the holiday season, our agents are on standby and ready to take your call at a moment's notice. Get ahead of the new year and contact our team here at PRD Penrith. If you'd like an up-to-date industry report on your property sector, speak to one of our agents, or visit our Research Hub for current property statistics and trends.

All information discussed in this blog has been gathered from relevant authoritative industry relevant/government sources; RBA, ABS, and PRD Research Hub.