Vacancy Rates back to pre-COVID-19 conditions

From the Desk of the Chief Economist – 15th September 2020

The rental market became a clear focus when many lost their jobs due to COVID-19, sparking fear of reduced rental prices and vacant homes. Vacancy rates, an indicator that measures the percentage of rental homes that remained unoccupied, became a key component to many investors’ decision-making process. A vacancy rate close to zero is most ideal, as it suggests available rental properties are rented.

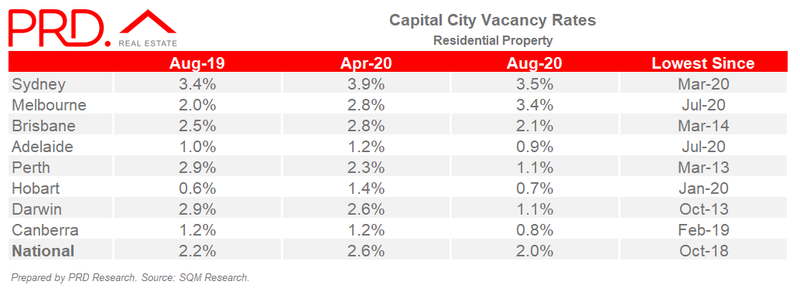

National vacancy rates data shows that although there was a spike to 2.6% in April 2020, at the height of COVID-19, it remained within the Real Estate Institute of Australia’s (REIA) healthy benchmark of 3.0%. This proves the resilience of Australia’s rental market, and although there might be temporary reductions in rental prices, there is some protection to landlord cashflows.

Only Sydney recorded a rate above the REIA’s healthy benchmark, of 3.9%, however this was understandable due to its level of dependency on international trade and international student movements.

The latest vacancy rates data, capturing August 2020, brings us great news. Nationally our rental market has recovered to pre-COVID-19 conditions, sitting at 2.0%. This eclipses a pre-COVID-19 vacancy rate of 2.2% (August 2019) and is the lowest recorded since October 2018.

Melbourne recorded a vacancy rate of 3.4% in August 2020, which represented an increase since April 2020. This is not a surprise due to current restrictions in Melbourne and the economic downturn. That said Melbourne’s vacancy rate is only slightly above the REIA’s healthy benchmark (3.0%), which suggests market resilience.

Brisbane and Perth are winners for investors, with vacancy rates at 2.1% and 1.1% (respectively), the lowest levels since March 2014 and March 2013. The rental markets in both capital cities have recovered to even better conditions than pre-COVID-19, of 2.5% and 2.9% in August 2019. This signals extremely conducive conditions for investment.

Hobart and Canberra hold the tightest vacancy rates in August 2020, of 0.7% and 0.8% respectively, making them some of the safest markets in Australia to invest in. Property prices in both markets are growing at steady rate, which suggest there is capital growth in the future.

Moving Forward

We are not at the end of COVID-19 yet, and there is the potential of further outbreaks as more businesses become operational and people’s movements are less restricted. However COVID-19 is now a part of our daily life, with policies and procedures embedded in how we operate.

The real estate market is well equipped in responding to any restrictions imposed due to COVID-19. Combined with Government (across all levels) and the Reserve Bank of Australia’s (RBA) commitment in applying fiscal and monetary policies that support economic growth, provide financial assistance, and stimulate job creation; the Australian property market continues to be a safe place for investment.