Housing Affordability and First Home Buyers

From the Desk of the Chief Economist - “Housing Affordability Declined but First Home Buyers are Winners”

The Australian property market has emerged as one of the strongest industries throughout COVID-19. There is evidence of numerous markets performing at their best in 2020, where capital cities have either experienced price growth or remained resilient when compared to 2019. The Real Estate Institute of Australia’s Housing Affordability Report for September Quarter 2020 revealed that market entry has experienced its largest year-on-year increase since 2009 and the largest quarterly increase since 2010.

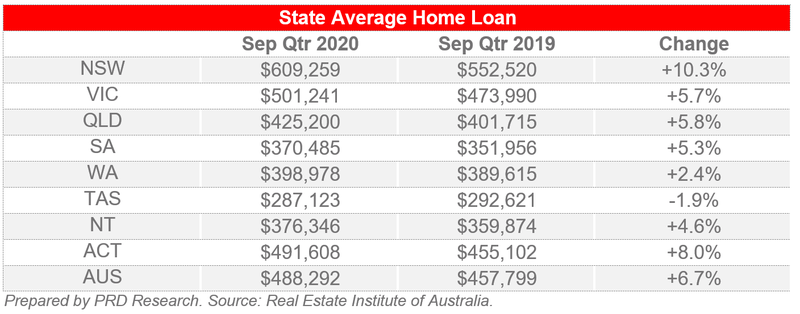

State Average Home Loan

Australia’s state average home loan has increased by 6.7% between September quarter 2019 and September quarter 2020, reflective of this year’s cash rate cuts and banks offering extremely low fixed interest rates. New South Wales (NSW) experienced the highest growth at 10.3%, followed by the Australian Capital Territory (ACT) at 8.0%. This is not a surprise as price growth in both states have grown significantly in the past 12 months, despite COVID-19. Interestingly Tasmania (TAS) is the only state with declining state average home loan growth, which can be a concern for first home buyers wanting to enter the market.

An increase in the state average home loan suggests that we are now more comfortable with higher lending values and is potentially approved to ensure buyers can keep up with increasing property prices. This a catch 22 situation; on one hand it allows buyers to enter the market by lowering the gap between a loan amount and the property price. On the other hand, it also creates higher debt for buyers and may take longer to service. The question is whether capital growth can offset the value of the debt, to ensure that property is servicing buyers’ future financial needs.

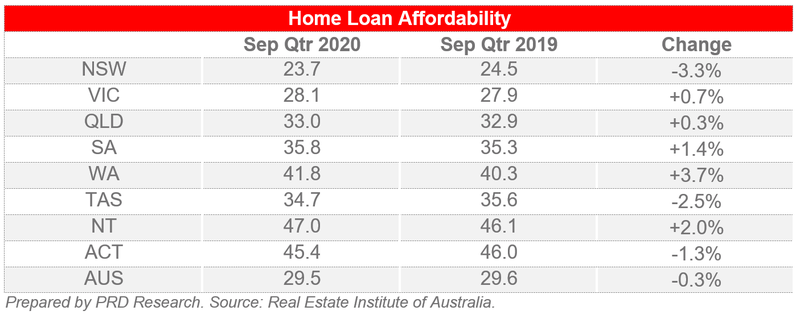

Home Loan Affordability

Home loan affordability is the ratio of median family income to average loan repayments, where an increase value reflects improving affordability of housing loans.

Unsurprisingly home loan affordability has declined, by -0.3% Australia-wide. This is in line with the increase in average home loans, which would require higher average loan repayments. The decline in home loan affordability may be a surprise to many, as there is an expectation of a slower property market due to COVID-19. However, at the same time the line of credit has been increased with evidence showing that, as an overall, property prices continued to grow after COVID-19’s peak in April/May 2020.

Home loan affordability improved the most for Western Australia (WA), by 3.7%, due to its previous softer market pre-COVID-19 and higher state average home loan for September quarter 2020. It is not a coincidence that WA recorded the highest growth in home loan affordability whilst also recording the lowest growth in state average home loan.

First home buyers in Victoria (VIC), Queensland (QLD), and South Australia (SA) can now capitalise on higher home loan affordability, allowing them to enter the market with more confidence.

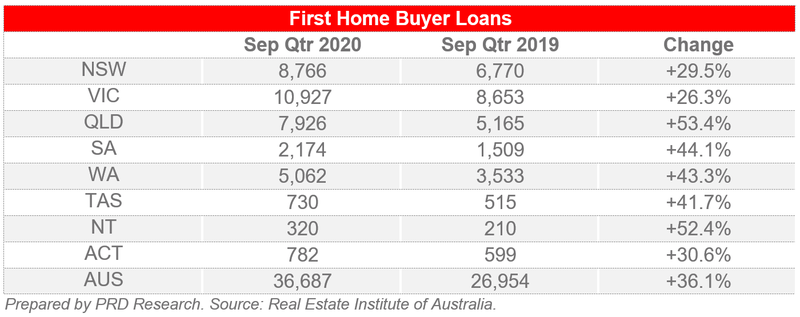

First Home Buyer Loans

First home buyers are the real winners in 2020, with an increase of 36.1% in the number of first home buyer loans approved Australia-wide between September quarter 2019 and September quarter 2020. This is not a surprise considering the trifecta of support system that current exists: Federal Government policy such as HomeBuilder and the First Home Loan Deposit, historical low cash rates with many banks offering low fixed home mortgage interest rates, and a price growth softening in several markets due to COVID-19.

QLD takes out the number one spot for the highest growth in first home buyers, increasing by 53.4% between September quarter 2019 and September quarter 2020. This has been spurred by QLD’s early timeline in easing of restrictions and re-opening of the economy. This also suggests that there is a high level of pent up demand in QLD, indicating the need for more greenfield housing in the future.

For the first time in many years first home buyer growth in NSW (29.5%) and VIC (26.3%) is lower than in other states, accounting for Sydney and Melbourne’s restrictions and tougher lockdowns. That said it is without a doubt that the growth seen in other states is at unprecedented levels compared to previous years, which has catapulted them above NSW and VIC’s growth. Historically first home buyer growth in NSW and VIC is between 20% to 30%, which suggests that despite COVID-19 conditions there is still a strong first home buyer market in both states.

Significance

Looking at state average home loans, home loan affordability, and first home buyer loan approvals, it is evident that the property market continues to grow despite COVID-19. Demand has bounced back in line with the easing of restrictions, further fuelled by government policies and the Reserve Bank of Australia’s cash rate cuts. The outlook for 2021 is positive, as the promise of a COVID-19 vaccine brings hope to us all, translating to higher consumer confidence. There is a tremor of uncertainty due to many government initiatives and grants finishing in the first quarter of 2021, however in part this is balanced with many economies – both within Australia and around the world - coming out of lockdown.