Opportunities are strongest in the Outer Ring

From the Desk of the Chief Economist

Secure the Outer Ring Opportunities

The PRD Major City Metro Update 2nd Half 2021 reports are available for Brisbane, Sydney, Melbourne, Hobart, Canberra, Perth, and the Gold Coast. Each report divides their respective capital city into inner (0-5kms), middle (5-10kms), and outer rings (10-20kms). These reports provide an in-depth analysis of each specific market in a simple manner, alongside a holistic picture of property conditions in each area.

Brisbane

- Brisbane’s inner ring has seen the highest median house price growth in the past 5 years, at 29.0%. This is repeated in a similar pattern for the unit market.

- Brisbane house buyers with a budget of $800,000 and less (the most affordable bracket) can only access 13.1% of the inner market. They can access 44.6% of the middle ring and 76.1% of the outer ring.

- Brisbane middle ring house buyers must pay the highest average vendor premium, of 3.2%. There is a similar pattern in the unit market, where middle ring buyers are the only ones who have to offer above the first list price.

- 3+ bedroom units in the inner and middle rings fetched the highest rental price

- Vacancy rates are the tightest in Brisbane’s outer ring, at 1.1% as of June 2021, indicating properties are being rented the fastest in these areas.

Sydney

- There is a large discrepancy (of $800K) between median house prices in Sydney’s outer ring ($1.6M) and inner and middle rings ($2.4M).

- House buyers with a budget of $1,500,000 or less can only access 11.1% of Sydney’s inner ring and 12.4% of the middle ring. They can access 43.1% of the outer ring.

- In Q2 2021 the only market in which buyers are paying a discount on the initial list price is Sydney’s outer ring unit market (-0.8%). However, this may be short-lived.

- 4+ bedroom houses in all of Sydney’s rings saw a median rental price decline over the 2020 to 2021 period. Comparatively, over the same period, 3+ bedroom units in Sydney’s inner and middle rings saw rental price increases.

- Sydney vacancy rates have recovered since their peak in the first major COVID lockdown in Q2 2020. All rings are close to reaching the healthy benchmark of 3.0%, with the inner ring at 3.1%.

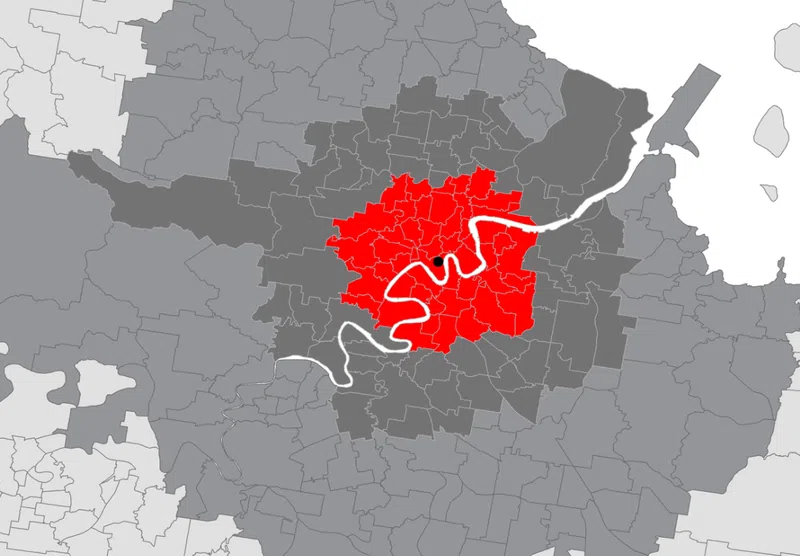

Melbourne

- Melbourne’s outer ring recorded the highest median price growth in the past 5 years for both houses and units, with 11.5% and 15.7% growth respectively.

- There has been high buyer activity within the premium price segments for both property types in all rings. Affordable opportunities are ample in outer ring houses.

- Average days to sell is the same for all three Melbourne rings for the first time in the past 18 months, all at record lows.

- Melbourne’s inner ring vacancy rates are on a declining trend since the peak of COVID-19 lockdowns and restrictions (October 2020). The outer ring vacancy rate is the closest to the Real Estate Institute of Australia Healthy benchmark of 3.0%.

- Melbourne’s outer ring recorded the highest rental yield for units, at 3.8%. House’s rental yield was strongest in the inner ring, at 2.8%.

Perth

- Over the past 5 years, Perth’s median house price in the middle ring has recorded the highest growth amongst other rings, at 15.7%.

- Despite only being able to access 9.7% of Perth’s inner ring with a budget of $550,000, the same amount will allow buyers access to 35.7% of middle ring houses and 52.5% of outer ring houses.

- Units are selling the fastest in Perth’s middle ring (43 days), whereas houses are selling fastest in the outer ring (34 days).

- Perth’s annual median house rent price grew the strongest in the outer ring, at 20.0%, whereas median unit rent price grew the strongest in the outer ring, with 18.5% growth.

- Vacancy rates in Perth’s middle and outer rings are sitting at a staggering 0.8% and 0.7% respectively. This indicates a shortage of housing and an increase in demand in Perth’s residential property market.

Hobart

- Hobart’s middle ring median unit price has grown by a staggering 56.7% between 2017-2021, with an average vendor premium of 7.0%

- Hobart buyers with a budget of $550,000 or less can only access 11.9% of inner ring housing stock. The same budget gives middle ring buyers access to 44.3% of the housing stock.

- Hobart has seen sellers able to sell at greater and greater premiums to their initial listed price. Houses in the middle ring record the highest average vendor premium of 8.8%.

- Houses in the middle ring recorded the highest annual median rent price growth, at 12.9%. Units in the inner ring recorded the highest annual median rent price growth, at 8.9%.

- 3+ bedroom units and 4+ bedroom houses in the inner ring are fetching the highest median rent, of $590 and $650 per week respectively.

Canberra

- Canberra’s inner ring houses recorded the highest median price growth of 37.0%.

- First home buyers in Canberra should look at the middle ring for both house and units, as there are higher transaction volumes within the lower price segments.

- Average vendor discounts swung to premium levels for all rings, creating a great opportunity for vendors to sell and achieve extraordinary results.

- Inner ring 2-bedroom houses saw the largest annual growth in median rent prices, at 17.2%

- Vacancy rates in Canberra continue to tighten for both rings, recording under 1.0%.

Gold Coast

- Over the past 5 years, the Gold Coast recorded double-digit median price growth for both property types in all rings. Middle ring houses recorded the highest median price growth of 32.5%.

- The Gold Coast is the only major city house market with equal opportunities in the most affordable price brackets, making it an ideal option for first home buyers.

- House average vendor discounts swung to premium levels for all rings, with the highest in the middle ring at 2.3%.

- The Gold Coast inner ring units recorded the highest annual median rental price growth, of 18.8%.

- Vacancy rates in the Gold Coast have continued to tighten for all rings, with the outer ring recording a historical low of 0.4%.

The PRD Major City Metro Update 2nd Half 2021 are available for all in-depth research on each of the major cities: Brisbane, Sydney, Melbourne, Hobart, Canberra, Perth, and the Gold Coast.