Affordable and Liveable Property Guides 2nd Half 2024

The PRD Affordable and Liveable Property Guides 2nd half 2024 are available for Brisbane, Sydney, Melbourne, and Hobart. These guides provide valuable insights on property trends and how current economic conditions (including higher interest rates) have impacted the market, as well as the planned housing supply for 2024 onwards. For those looking for more affordable options (compared to the capital city metro area) these guides provide key suburbs that have passed the affordability, investment, liveability, and future residential stock supply criteria.

As featured on:

Download:

Download - Affordable and Liveable Brisbane Metro Property Guide 2nd Half 2024.pdf

Download - Affordable and Liveable Hobart Metro Property Guide 2nd Half 2024.pdf

Download - Affordable and Liveable Melbourne Metro Property Guide 2nd Half 2024.pdf

Download - Affordable and Liveable Sydney Metro Property Guide 2nd Half 2024.pdf

Key Findings

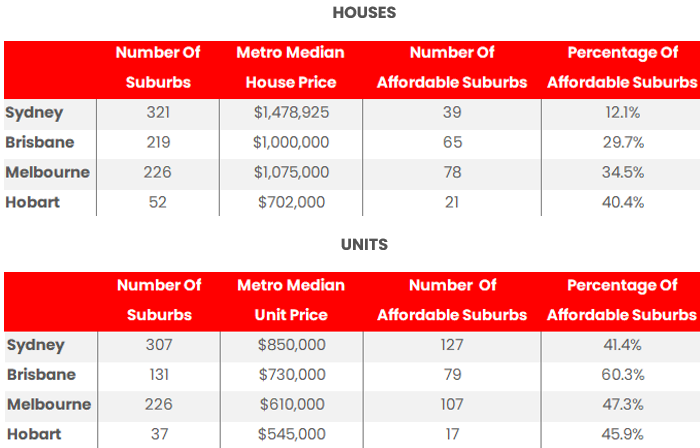

- The move to purchasing units is inevitable. The percentage of affordable suburbs (i.e. suburbs with a lower median price than the relevant Metro) for units is much higher, at an average of 48.7% across Sydney Brisbane Melbourne and Hobart. This is better than 29.2% for houses. Brisbane is friendliest for units, with 60.3% of suburbs considered more affordable.

- Hobart proves to be the capital city of choice for house buyers, with 40.4% of affordable suburbs. Melbourne has taken over from Brisbane, with 34.5% of more affordable house suburbs, which is slightly higher than Brisbane’s 29.7%. Sydney remains the most expensive.

- Those looking for units should consider Brisbane, as there are 60.3% of affordable suburbs available. Considering that Brisbane unit prices have taken over Melbourne’s, this creates an opportunity for first-home buyers.

- As per the 2023 and 1st half of 2024 guides, we had to sacrifice the unemployment rate in favour of ensuring a reasonable amount of ready-to-sell residential projects. This suggests that home buyers need to travel longer distances to their jobs. This was particularly prevalent in Brisbane, followed by Hobart.

- Choosing an affordable and liveable suburb in Brisbane was the most difficult, due to property price growth in most of Brisbane’s suburbs and a low level of new residential stock planned. Sydney and Melbourne proved easier, as many suburbs are still experiencing negative or low-price growth and a higher level of new residential stock in the pipeline.

Percentage of Affordable Suburbs

Tables 1A and 1B illustrate the percentage of affordable suburbs in each capital city, wherein an ‘affordable suburb’ is defined as a suburb that has a lower median house/unit price compared to the relevant metro area. These tables suggest there is more hope for Brisbane unit buyers, followed by Melbourne. Hobart has reclaimed its title as the most affordable capital city for house buyers.

Table 1A and 1B Percentage of Affordable Suburbs | 2nd Half 2024

Metro median house/unit price represent sales 1st January - 30th September 2024. Affordable Suburbs are suburbs with a median house/unit price below the Metro median house/unit price. Number of Suburbs is the number of suburbs from CBD + 20km diameter.

Source: CoreLogic 1st May 2024, APM Pricefinder

Affordable & Liveable Suburbs

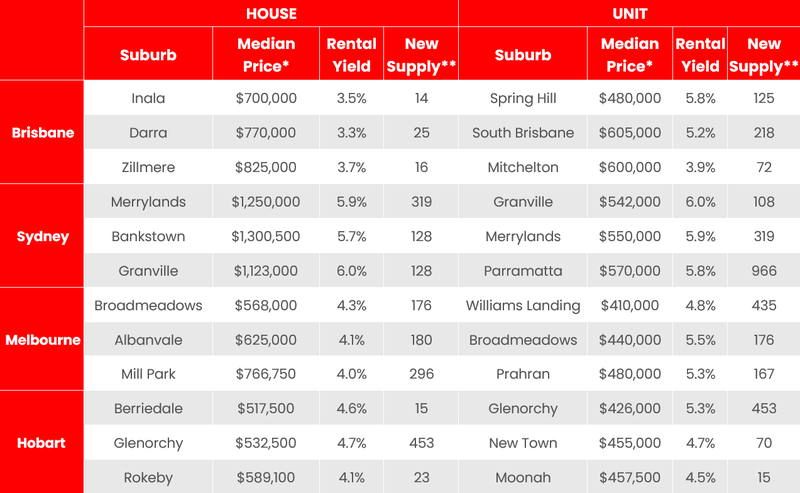

Table 2 identifies affordable and liveable suburbs that have met all methodology criteria. Hobart has the most affordable suburbs for houses, followed by Melbourne. Chosen suburbs for units show median prices that are roughly on par between all four capital cities, however, due to ensuring a reasonable amount of ready-to-sell stock is planned, some unit suburbs in Brisbane are higher priced than Sydney. This is a first for Brisbane, which suggests that to access new stock, Brisbane buyers must sacrifice affordability for availability.

Table 2. Affordable and Liveable Suburbs

Methodology

Each Affordable and Liveable Property Guide focuses on suburbs within a 20km radius of the CBD (or 10km for Hobart) and takes into consideration the following criteria:

- Property trends criteria – all suburbs have a minimum of 20 sales transactions for statistical reliability purposes. Based on market conditions suburbs have either positive, or as close as possible, to neutral price growth between 2023 and 2024.

- Investment criteria – as of September 2024, suburbs considered will have an on-par or higher rental yield than the relevant Metro area, and an on-par or lower vacancy rate.

- Affordability criteria – identified affordable and liveable suburbs have a median price below the relevant capital city metro area, and below a set threshold. This threshold was set by adding a percentage premium to the respective State’s average home loan^. The percentage premium needed to achieve the affordable and liveable suburb’s median house/unit price must be lower than the percentage premium needed to achieve the City Metro area’s median house/unit price. This ensures higher affordability.

- Development criteria – suburbs identified must have a high total estimated value of future project development for 2024, with a high proportion of commercial and infrastructure projects. This ensures the suburbs show signs of sustainable economic growth. Suburbs must also show a reasonable amount of new ready-to-sell stock planned for construction, to ensure there is stock available for buyers.

- Liveability criteria – all identified suburbs have low crime rates, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres and health care facilities), and an unemployment rate on-par or lower in comparison to the state average (as determined by the Department of Jobs and Small Business in the June Quarter of 2024 release).

*Median price quoted captures sale transactions from 1st January 2024 to 30th September 2024, or Q1 2024 – Q3 2024.

**New Supply is based on aggregate number of ready-to-sell townhouses, units, dwellings scheduled to commence construction in 2024, as stated by the relevant data authority.

^ Average home loan figure is derived from June Quarter 2024 Housing Affordability Report by the Real Estate Institute of Australia (REIA) and Adelaide Bank.