Affordable & Liveable Property Guide 2nd Half 2020 - Hobart

Median property prices in Hobart Metro increased by 4.7% for houses to $560,000 from 2019 to 20201 and increased by 4.2% to $422,000 for units during the same period. By comparison, from 2018 to 2019 the median house price in Hobart Metro increased by 5.7%, while the median unit price grew by 4.5%. Limited stock coupled with high demand has continued to push prices upwards, resulting in the need to sacrifice affordability for liveability.

Overview

Median property prices in Hobart Metro increased by 4.7% for houses to $560,000 from 2019 to 20201 and increased by 4.2% to $422,000 for units during the same period. By comparison, from 2018 to 2019 the median house price in Hobart Metro increased by 5.7%, while the median unit price grew by 4.5%. Limited stock coupled with high demand has continued to push prices upwards, resulting in the need to sacrifice affordability for liveability.

Hobart Metro recorded healthy price growth in both houses and units in the past five years, thus property owners can be confident in their asset’s ongoing value. A limited residential development pipeline creates urgent opportunities for the local government and developers to collaborate in ensuring housing supply constraints are eased in the near future.

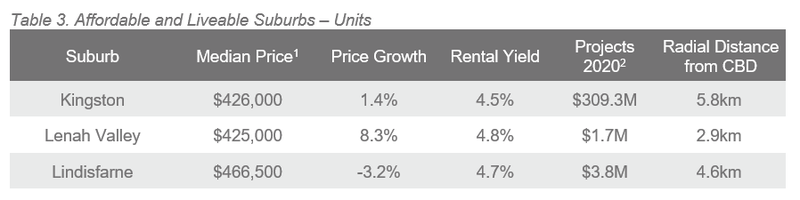

In the 2nd Half 2020 report unit rental performance within each suburb was reconsidered. Suburbs with a unit average rental yield marginally below Hobart Metro could be chosen as an affordable liveable suburb, as the impact of COVID-19 on the property market was most evident in this investment criteria.

To identify an affordable and liveable suburb within 10kms of Hobart Metro the premiums added to the Tasmania (TAS) average loan had to be above the premiums added to reach Hobart Metro’s median property prices. Thus, Hobart residents need to sacrifice affordability for liveability. This is a recurring adjustment of methodology for Hobart Metro over the past three Affordable and Liveable Property Guides, highlighting the ongoing issue of affordability of liveable suburbs within Hobart Metro.

In addition, some suburbs with softening annual median house or unit price growth had to be considered. This is similar to the methodology applied in the 1st Half 2019€, 2nd Half 2019¥, and 1st Half 2020₳ reports. This presents an opportunity for buyers, with softer median prices offering a more affordable chance to enter the market.

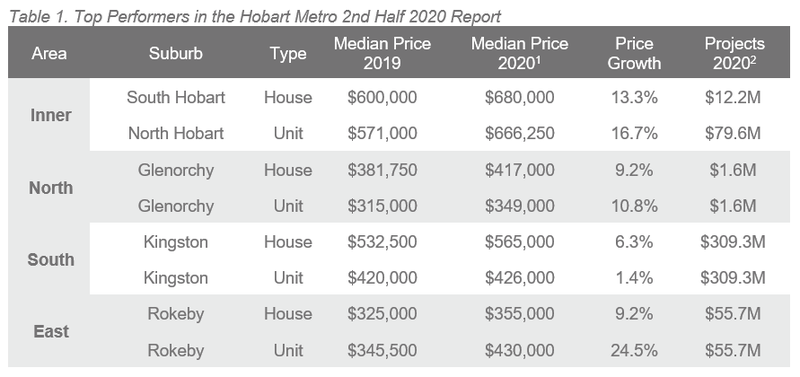

Table 1 highlights top suburbs in Hobart Metro based on price growth and total estimated value of projects commencing in the 2nd half of 20202.

Access to Market

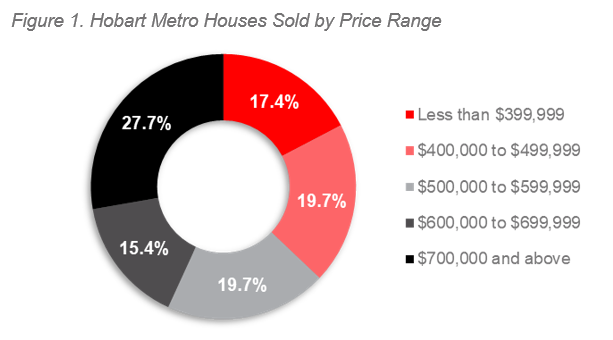

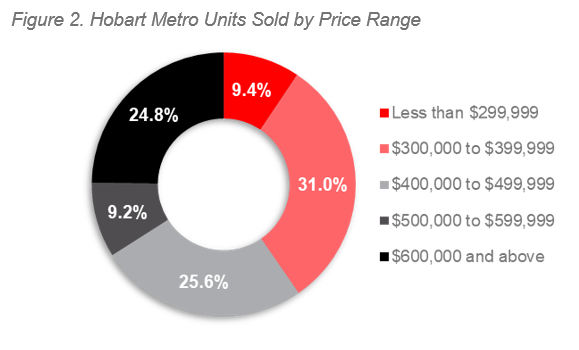

The dominant proportion of homes sold in Hobart Metro during 20201 were in the premium price bracket of $700,000 and above (27.7%), while units recorded a dominant lower-middle price point of $300,000 to $400,000 (31.0%) (as shown in Figures 1 and 2). This reveals that there is affordably priced stock available, however buyers must act quickly.

Affordable and Liveable Suburbs

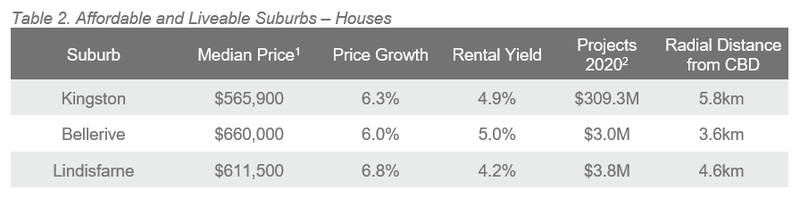

To identify affordable and liveable suburbs premiums of 92% for houses and 36% for units were added to the TAS average home loan, which were above those required to reach Hobart Metro’s median prices (62% for houses and 22% for units). Thus, the affordable and liveable suburbs above Hobart Metro’s median prices, meaning that the suburbs identified within this report are less affordable for buyers.

Considering all methodology criteria (property trends, investment, affordability, development, and liveability), Tables 2 and 3 identify key suburbs that property watchers should be focused on.

In September 2020, house rental yields in Hobart Metro were 4.1%. In the 12 months to Q3 2020, the median house rent increased to $470 per week, while average days on the market declined by -4.8% to 20 days. Overall, this suggests Hobart Metro has retained a highly resilient rental market throughout COVID-19.

In September 2020, Hobart Metro recorded a very low vacancy rate of 0.6%, well below both Sydney Metro (3.5%) and Melbourne Metro (3.8%). Vacancy rates in Hobart Metro remain well below the Real Estate Institute of Australia’s healthy benchmark of 3.0%, even amid COVID-19 conditions. Further, the Hobart Metro vacancy rate has shown a declining trend since peaking in April 2020 due to COVID-19, which confirms there is a healthy ongoing rental demand.

Methodology

This affordable and liveable property guide for Hobart Metro analyses all suburbs within a 10km radius of the Hobart CBD. The following criteria were considered:

- Property trends criteria – all suburbs have a minimum of 20 sales transactions for statistical reliability purposes. Based on market conditions suburbs have either positive, or as close as possible to neutral price growth between 2019 to 20201.

- Investment criteria – as of September 2020, suburbs considered will have an on-par or higher rental yield than Hobart Metro, and an on-par or lower vacancy rate.

- Affordability criteria – identified affordable and liveable suburbs have a median price below a set threshold. This was determined by adding percentage premiums to the TAS average home loan, which was $344,8253 as of Q2 2020. Premiums of 92% for houses and 36% for units were added, which were above those required to reach Hobart Metro’s median prices (62% for houses and 22% for units). This places the suburbs above Hobart’s median prices, meaning buyers must sacrifice affordability to find liveable suburbs in Hobart.

- Development criteria – suburbs identified must have a high total estimated value of future project development for the 2nd half of 20202, as well as a higher proportion of commercial and infrastructure projects. This ensures the suburbs show signs of sustainable economic growth, in turn positively affecting the property market.

- Liveability criteria – all identified suburbs have low crime rates, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres and health care facilities), and an unemployment rate on-par or lower in comparison to the TAS average (as determined by the Department of Jobs and Small Business, June Quarter 2020 release).

PRD Affordable and Liveable Property Guide 2nd Half 2020 - Hobart