From the Desk of the Chief Economist- Federal Budget 2023 and RBA May Statement of Monetary Policy: What's Next for Australia?

On Friday 5th May the Reserve Bank of Australia handed down its May Statement of Monetary Policy 2023, discussing the state of the economy after 11 cash rate hikes. This is followed by the Federal Government handing down its highly anticipated Federal Budget 2032 on Tuesday 9th May, which promised us to be a “cost-of-living centric” Budget. Was there a policy mismatch or does it address our current reality? Will we see a recession at the end of 2023? Where to now? What does it mean for the housing / real estate industry? Read our holistic and comprehensive analysis in the latest “From the Desk of the Chief Economist”

Financial Stability Review

Prior to the release of the RBA’s May Statement of Monetary Policy and Federal Budget 2023, the RBA released its Financial Stability Review on 6 April 2023. A key was one of strength and resilience at an aggregate (i.e., nation-wide, all Australians) level. That said, the RBA has observed increased pressure for certain demographics and different sectors, which in RBA terms are called ‘the distribution’. Although components within the distribution are very varied, there is not enough ‘turn’ in the data and this has little impact on the aggregate.

Unlike the USA, Australia has entered this period of economic uncertainty with extremely high savings buffers. This puts us in a much better position to face any potential windfall.

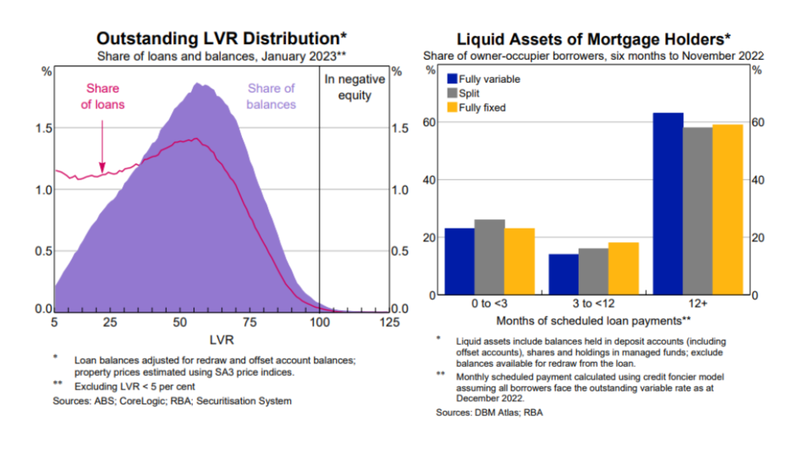

Home-loan mortgage buffers remain large, but there is an uneven picture across the distribution of borrowers. Most borrowers have more than 12 months in buffers, but there is a tail of borrowers in distress. At present, approx. 15–18% dipped into their savings buffers.

Overall, there are very few households (at an aggregate level) that are in negative equity. At present, most people have transitioned from a low fixed cash rate quite smoothly due to a high mortgage offset account. However, these are early days, as more than two thirds of borrowers have not transitioned through.

Federal Budget 2023

"For too long, secure, affordable housing has been out of reach for too many Australians," said Treasurer Jim Chalmers when the Federal Budget 2023 was handed down. Due to the Federal Budget 2023 being placed as the "cost of living" budget, specific and direct initiatives for the housing industry were quite slim. For this budget, single parents, welfare recipients, and those aged 55 and older are among those named as winners. This budget is in contrast to the Federal Budget 2020, where first home buyers were among the winners.

Federal Budget 2023 key measures for housing include:

- Expansion of home guarantee schemes, which will be available to friends, siblings, and other family members, non-first-home buyers who have not owned a property for 10 years or longer, single legal guardians of dependents, and permanent residents.

- Tax incentives for the private sector on Build-to-Rent projects that commence construction after the release of the budget

- An increase to the maximum rate of the Commonwealth Rent Assistance (CRA) program by 15% (equivalent to up to $31 per fortnight) from September 2023. This is available to those currently receiving government support payments.

- The National Housing Finance and Investment Corporation (NHFIC) liability cap will increase by $2 billion (to $7.5 billion) to build more affordable social housing as of 1 July 2023. This is expected to translate into an additional 7,000 affordable homes.

- Additional $67.5 million to boost homelessness funding in the states and territories.

There are a range of other initiatives that are designed to impact housing indirectly by adding more money to the household budget. This includes an increase in Jobseeker, Austudy, and Youth Allowance payments, investment in Medicare and the health industry, changes in single-parent benefits, energy price relief (i.e., power bills), and others. The idea, of course, is that the money added here contributes to increasing rent or mortgage repayments.

From a business perspective, there is some good news. Real estate agencies with turnovers under $10 million can benefit from an instant $20,000 asset write as well as a $20,000–$100,000 green tax boost.

The Federal Government has thus far addressed housing affordability by incentivising demand, making it even easier for people to own. This continues in the Federal Budget 2023 with the expansion of home guarantee schemes. They did incentivise supply through tax cuts for build-to-rent, but this benefits renters. This is, in essence, a policy mismatch.

That said, stimulating private supply can be difficult, as planning strategies, development approvals, etc. are within the authority of local government councils. And "the only thing" that the federal government can call upon is greater coordination between all three levels of government. This is challenging due to varying needs and priorities at a local level.

RBA – May Statement of Monetary Policy

The words "inflation" and "cash rate" have become very front of mind to most Australians, with many monitoring the first Tuesday of every month. A higher cash rate translates to higher mortgage payments, which will have a direct impact on the household budget.

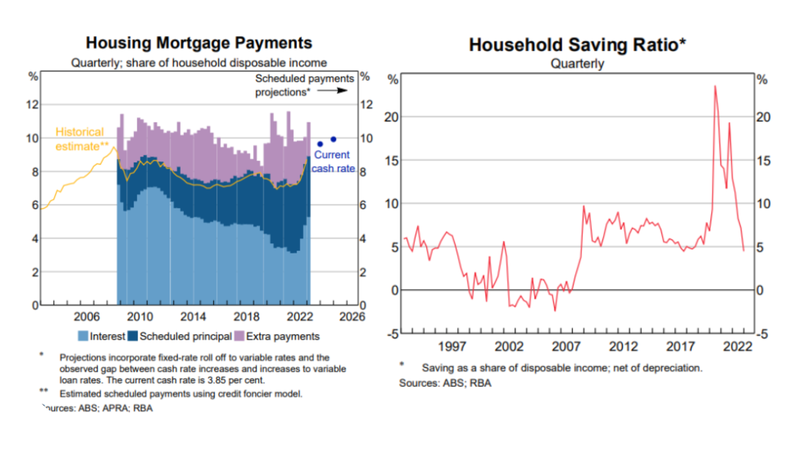

Due to the built up buffer in mortgage offsets, there seems to be little impact on housing mortgage payments. Interest and scheduled principal payments have increased in the past 12 months. However, mortgage offset accounts have continued to increase, albeit at a slower pace than during COVID-19. This shows the resilience of the economy.

Perhaps more worrying is the state of the household balance sheet, particularly the savings ratio. Throughout COVID-19, household savings built up to more than 20%. This did put us in a strong position to weather economic uncertainty. However, as of the March quarter of 2023, these savings sat at just below 5%, which is lower than pre-COVID-19 and the long-running average. This brings into question a household’s ability to afford goods and services in the short term, as inflation and the cost of living are still high.

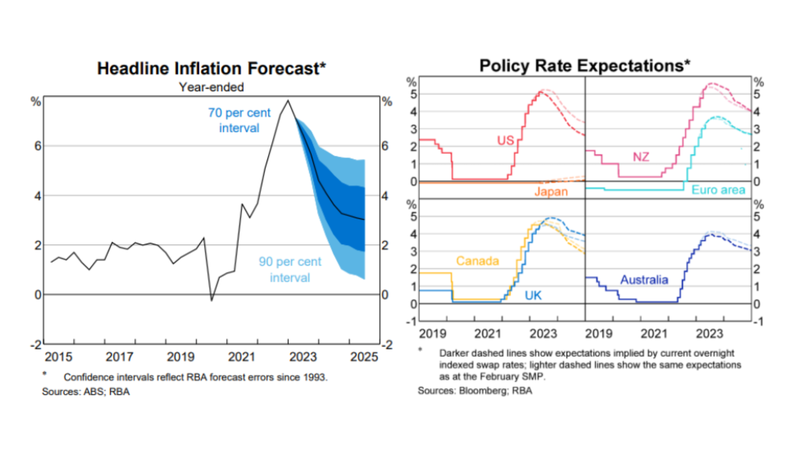

As of the March quarter of 2023, our inflation rate was 7.0%. This represents a declining trend in comparison to 12 months prior, which suggests inflation has peaked. However, it is still quite far away from the healthy target of 2–3%. The RBA is quite confident that inflation will come down; the question is how fast and where. Headline inflation is projected to reach 3% by 2025, assuming cash rates continue their current trend and other economic and political indicators remain stable.

After 11 cash rate hikes, we are now sitting at 3.85%, quite close to the 4.0% policy rate expectations in the May 2023 Statement of Monetary Policy. A 4.0% cash rate peak for Australia is lower than many other developed countries, such as Canada, New Zealand, the USA, and the United Kingdom, all of which expect a cash rate peak of approximately 5.0%.

The RBA acknowledges that it is hard to "see through everything" at the moment, as all cost-of-living items have increased substantially, and households are hit with a double whammy.

The RBA continues to forecast that cash rates will return to just above 3.0% in 2025, which is lower than New Zealand and the United Kingdom but on par with other countries such as Canada, the USA, and Europe.

Moving Forward

Will we see a recession at the end of 2023?

It seems that both the RBA and the Federal Government have the same answer: growth is going to be slower but not subtractive. The current way policy, whether cash rate or Federal Budget, is being created to try and avoid another recession. Thus, the economy will continue to grow, but at a lower potential rate to bring inflation down.

Policy, both monetary (RBA) and fiscal (government), has traditionally been created based on the aggregate. That is, Australians are in the majority. The past three years have seen ‘the distribution’ become more evident, due to both external circumstances (i.e., COVID-19, war, and others) and how the RBA and Federal Government have reacted. For example:

A. The Australian real estate market has become more segregated, and we have markets within markets within markets.

B. Home-loan borrowers who put down a traditional 20% deposit and those who took advantage of the First Home Guarantee(s)’ 2-5% deposit offerings.

C. Households who took advantage of the Federal Government’s early one-off superannuation access and increased savings, and those whose income is from welfare payments.

The mismatch between how policy is created (i.e., based on aggregate or Australia-wide data) and our individual experiences as a society (i.e., at ‘the distribution’ or different demographics and sectors or industries) causes frustration and uncertainty. The RBA is now more aware of the distribution and how rapidly it is changing. Monitoring any turns in the distribution has been increased, to "catch" any turns before they impact the aggregate. From this, one hopes that future policies will be somewhat more in tune with reality.

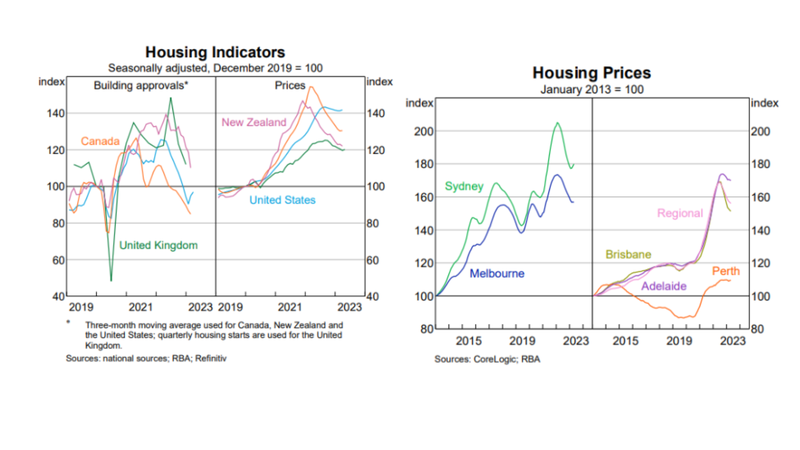

Housing prices did see a decline throughout the period of 11 cash rate hikes, more so in Sydney and Melbourne and less in Brisbane, Adelaide, and regional areas. That said, as of the March quarter of 2023, we are seeing some housing markets, regardless of capital city or regional, start to turn. This is consistent with other countries, such as Canada and the UK.

The RBA did admit that the turn in housing prices was quicker than expected, which shows real resilience in the housing market. That said, the turn in house prices can be attributed more to a lack of supply than a significant increase in demand. For property markets with very little ready-to-sell stand-alone housing stock planned, the downturn in prices was temporary. Thus, time is of the essence for those looking for a more affordable market.