Affordable & Liveable Property Guide 1st Half 2021 - Hobart

Median property prices in Hobart Metro increased by 10.3% for houses to $640,000 from Q1 2020 to Q1 20211, and also increased for units by 17.5% to reach $520,000. Across the same period, total house sales in Hobart Metro increased by 0.5% to 438 sales, while unit sales slowed by -30.0% to 149 sales. Hobart Metro’s median price activity has occurred amidst relatively limited transaction growth within the market, due to COVID-19’s initial impact on sales in Q1 2020. This said, those looking to sell within Hobart Metro can have confidence with prices continuing to rise, particularly in the undersupplied unit market.

Overview

Median property prices in Hobart Metro increased by 10.3% for houses to $640,000 from Q1 2020 to Q1 20211, and also increased for units by 17.5% to reach $520,000. Across the same period, total house sales in Hobart Metro increased by 0.5% to 438 sales, while unit sales slowed by -30.0% to 149 sales. Hobart Metro’s median price activity has occurred amidst relatively limited transaction growth within the market, due to COVID-19’s initial impact on sales in Q1 2020. This said, those looking to sell within Hobart Metro can have confidence with prices continuing to rise, particularly in the undersupplied unit market.

In the 1st Half 2021 report, rental performance within each suburb was reconsidered. Suburbs with an average rental yield marginally below Hobart Metro could be chosen as an affordable liveable suburb, as the impact of COVID-19 on the property market was most evident in this investment criteria.

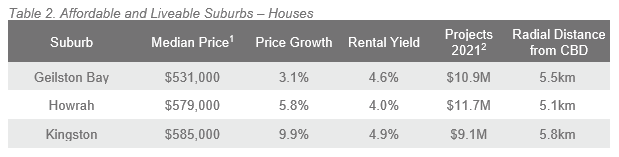

To identify an affordable and liveable suburb within 10kms of Hobart Metro the premiums added to the Tasmanian (TAS) average loan were below the premiums added to reach Hobart Metro’s median property prices. This is a significant change from the last three Affordable and Liveable Property Guides for Hobart. Thus, Hobart residents no longer need to sacrifice affordability for liveability.

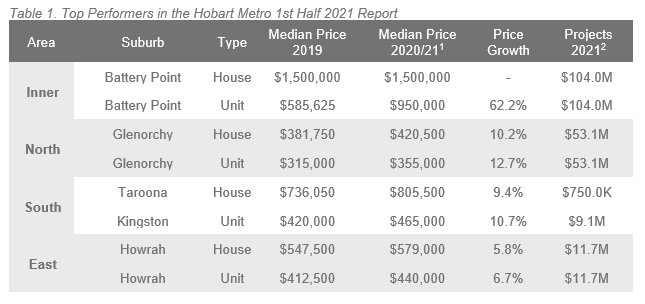

Table 1 highlights the top suburbs in Hobart Metro, based on price growth and total estimated value of projects commencing in the 1st half of 20212.

Access to Market

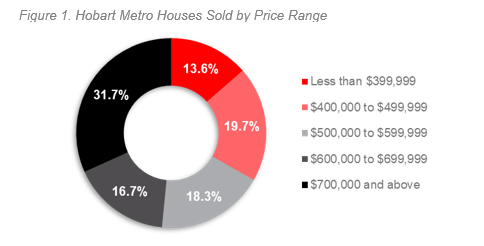

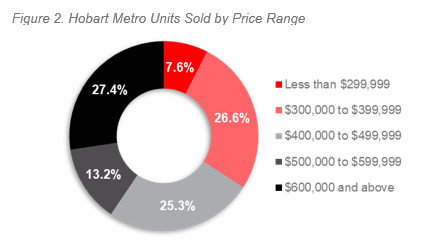

The dominant proportion of homes sold in Hobart Metro across 2020/211 were in the premium price bracket of above $700,000 (31.7%). Units also recorded a dominant premium price bracket of above $600,000 (27.4%%). Hobart Metro’s house market has shifted towards premium pricing, with less stock in the most affordable price points. There is still an even spread in price points for units, however first home buyers must act quickly.

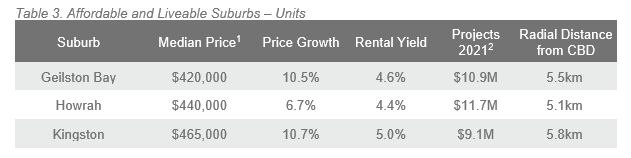

Affordable and Liveable Suburbs

To identify affordable and liveable suburbs, premiums of 57% for houses and 25% for units were added to the TAS average home loan, which were below those required to reach Hobart Metro’s median prices (71% for houses and 39% for units). Thus, the chosen suburbs have a median price that sit below Hobart Metro’s median prices, meaning that the suburbs identified within this report are more affordable for buyers.

Considering all methodology criteria (property trends, investment, affordability, development, and liveability), Tables 2 and 3 identify key suburbs that property watchers should be focused on.

Investment Opportunities

In March 2021, house rental yields in Hobart Metro were recorded at 3.9%. In the 12 months to Q1 2021, the median house rental price increased by 2.0% to reach $505 per week, while average days on the market declined by -24.0% (to 19 days).

In March 2021, Hobart Metro recorded a very low vacancy rate of 0.6%, below that of Melbourne Metro (4.4%) and Sydney Metro (3.5%). Vacancy rates in Hobart Metro also sit well below the Real Estate Institute of Australia’s healthy benchmark of 3.0%, which was also the case prior to COVID-19. Further, Hobart Metro’s vacancy rate has shown a declining trend since peaking in April 2020 due to COVID-19, signifying a healthier rental demand and quicker cash flow for investors.

Overall, the Hobart Metro rental house market

has remained highly resilient throughout COVID-19. This offers investors

confidence in what is a consistently strong market.

Methodology

This affordable and liveable property guide for Hobart Metro analyses all suburbs within a 10km radius of Hobart CBD. The following criteria were considered:

- Property trends criteria – all suburbs have a minimum of 10 sales transactions for statistical reliability purposes. Based on market conditions, suburbs have either positive or as close as possible to neutral price growth between 2019 to 2020/211.

- Investment criteria – as of March 2021, suburbs considered will have an on-par or higher rental yield than Hobart Metro, and an on-par or lower vacancy rate.

- Affordability criteria – identified affordable and liveable suburbs have a median price below a set threshold. This was determined by adding percentage premiums to the TAS average home loan, which was $373,5213 as of Q4 2020. Premiums of 57% for houses and 25% for units were added, which were below those required to reach Hobart Metro’s median prices (71% for houses and 39% for units). This places the suburbs below Hobart’s median prices, meaning that the suburbs identified within this report are more affordable for buyers.

- Development criteria – suburbs identified must have a high total estimated value of future project development for the 1st half of 20212, as well as a higher proportion of commercial and infrastructure projects. This ensures the suburbs show signs of sustainable economic growth, in turn positively affecting the property market.

- Liveability criteria – all identified suburbs have low crime rates, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres and health care facilities), and an unemployment rate on-par or lower in comparison to the TAS average (as determined by the Department of Jobs and Small Business, December Quarter 2020 release).

PRD Affordable and Liveable Property Guides 1st Half 2021 - Hobart