Affordable & Liveable Property Guide 2nd Half 2021 - Brisbane

Median property prices in Brisbane Metro increased by 22.3% for houses to $825,000 from Q3 2020 to Q3 2021*, and by 3.6% for units at $465,000. Between Q3 2020 – Q3 2021 total house sales declined by -11.7% (to 4,902 sales), but unit sales increased by 121.9% (to 4,043 sales). Undersupply is evident in Brisbane Metro’s house market, as price growth is alongside lower transaction volumes, suggesting an imbalance between available stock and high demand. Units show real returns in capital investment, as price growth was sustained by increased sales.

Overview

Median property prices in Brisbane Metro increased by 22.3% for houses to $825,000 from Q3 2020 to Q3 2021*, and by 3.6% for units at $465,000. Between Q3 2020 – Q3 2021 total house sales declined by -11.7% (to 4,902 sales), but unit sales increased by 121.9% (to 4,043 sales). Undersupply is evident in Brisbane Metro’s house market, as price growth is alongside lower transaction volumes, suggesting an imbalance between available stock and high demand. Units show real returns in capital investment, as price growth was sustained by increased sales.

First home buyer activity in Queensland (QLD) has significantly increased in the past 12 months, by approximately 40%. This is the highest growth across all states in Australia. There has been an increase in activity since the Olympics 2032 and roadmap to interstate and overseas announcements, with investors returning to the market in preparation for future demand.

Interestingly, all chosen affordable and liveable suburbs are located within the middle and outer ring of the Brisbane CBD. This is a clear indication of increasing movement away from the CBD due to flexible working arrangements, further confirmed by record low vacancy rates in the middle-outer ring areas. The outer ring also provides higher affordability, particularly for those looking to purchase a house.

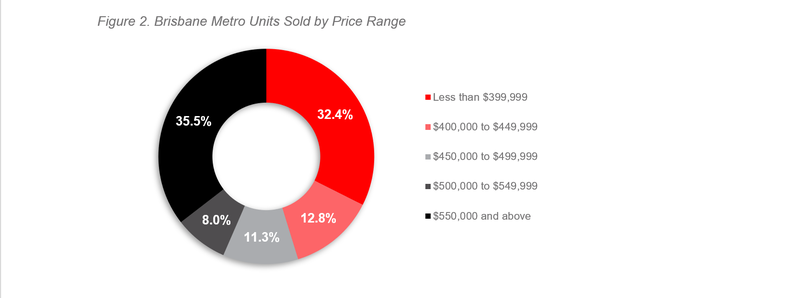

Table 1 highlights the top suburbs in Brisbane Metro based on price growth and total estimated value of projects commencing in the 2nd half of 20212.

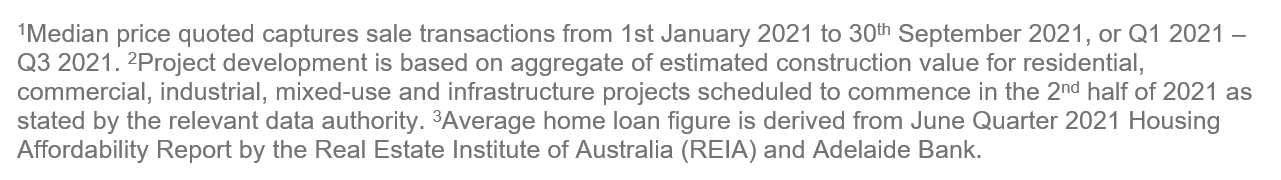

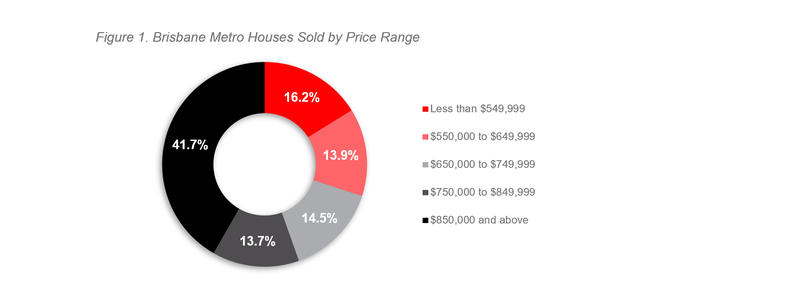

Access to Market

The dominant proportion of homes sold in Brisbane Metro across 2021# were in the premium price bracket of $850,000 and above (41.7%). Units also recorded a dominant premium price bracket of $550,000 and above (35.5%). There is a shift towards premium pricing in Brisbane Metro. Affordable options are still available, however have shrunk in the past 12 months.

Figure 1. Hobart Metro Houses Sold by Price Range

Affordable and Liveable Suburbs

To identify affordable and liveable suburbs, premiums of 56% for houses and -3% for units were added to the QLD average home loan, which were below those required to reach Brisbane Metro’s median prices (79% for houses and 1% for units). Thus, the chosen suburbs have a median price below that of Brisbane Metro’s, meaning that the suburbs identified within this report are more affordable for buyers.

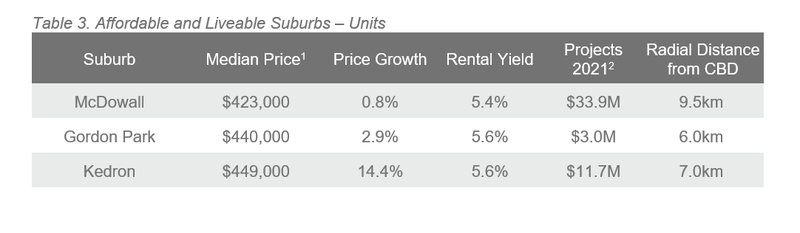

Considering all methodology criteria (property trends, investment, affordability, development, and liveability), Tables 2 and 3 identify key suburbs that property watchers should focus on.

Investment Opportunities

In September 2021, house rental yields in Brisbane Metro were recorded at 3.7%. In the 12 months to Q3 2021, the median house rental price increased by 11.1% to $500 per week, further complemented with a low ‘average days on the market’ of 21 days.

In September 2021, Brisbane Metro recorded a low vacancy rate of 1.4%, well below that of Sydney Metro (2.7%) and Melbourne Metro (3.5%). Vacancy rates in Brisbane Metro remained well below the Real Estate Institute of Australia’s healthy benchmark of 3.0%, even throughout COVID-19. Brisbane Metro’s vacancy rate continues to show a declining trend since January 2021, showcasing historical low trends in the past 18 months. This should provide greater confidence to investors.

Methodology

This affordable and liveable property guide for Brisbane Metro analyses all suburbs within a 20km radius of the Brisbane CBD. The following criteria were considered:

Property trends criteria – all suburbs have a minimum of 20 sales transactions for statistical reliability purposes. Based on market conditions, suburbs have either positive, or as close as possible to neutral price growth between 2020 to 2021*.

Investment criteria – as of September 2021, suburbs considered will have an on-par or higher rental yield than Brisbane Metro, and an on-par or lower vacancy rate.

Affordability criteria – identified affordable and liveable suburbs have a median price below a set threshold. This was determined by adding percentage premiums to the QLD average home loan, which was $461,414** as of Q2 2021. Premiums of 56% for houses and -3% for units were added, which were below those required to reach Brisbane Metro’s median prices (79% for houses and 1% for units). This places the chosen suburbs below Brisbane’s median prices, meaning that the suburbs identified within this report are more affordable for buyers.

Development criteria – suburbs identified must have a high total estimated value of future project development for the 2nd half of 2021, as well as a higher proportion of commercial and infrastructure projects. This ensures the suburbs show signs of sustainable economic growth, in turn positively affecting the property market.

Liveability criteria – all identified suburbs have low crime rates, availability of amenities within a 5km radius (i.e. schools, green spaces, public transport, shopping centres and health care facilities), and an unemployment rate on-par or lower in comparison to the QLD average (as determined by the Department of Jobs and Small Business, June Quarter 2021 release).